Hydraulic systems are under growing demand and substantial development work. For example, steel and aluminum hydraulic manifolds have come to replace legacy fluid power control systems that consisted of components connected via pipes, hoses, or tubes. The key value add is that hydraulic manifolds require less space, withstand higher pressures and are more durable.

Hydraulic manifolds have become an essential part of industries with high power requirements for mobile and stationary equipment, particularly in hazardous environments where stable and reliable performance is a condition for safe operations. Below we list some key industries that drive demand for hydraulic equipment.

Mobile applications

- Construction: hydraulic excavators, bulldozers, drills, and backhoes all incorporate modern hydraulic systems for precise control over the heavy-duty lifting and digging tasks.

- Agriculture: tractors, combines, and sprayers utilize hydraulic systems for functions like steering and lifting.

- Mining: hydraulic shovels, drills, and haul trucks are essential in both underground and surface mining operations as well as exploration activities.

- Forestry: equipment like harvesters and forwarders use hydraulics for felling, cutting, and transporting trees.

- Material Handling: forklifts and pallet jacks often incorporate hydraulic systems for lifting and moving goods.

Stationary applications

- Manufacturing: machines like presses, conveyors, and injection molding machines use hydraulics for precise operations.

- Energy: In oil and gas, applications include hydraulic systems in onshore and offshore drill rigs. In renewable energy sectors like hydro and wind, hydraulics are used in turbines and other control systems.

- Waste management: compactors and balers use hydraulic systems to compress waste materials efficiently.

- Food Processing: Hydraulic systems are used in machinery for tasks like cutting, slicing, and packaging.

- Maritime: dockside cranes, shipboard systems, and subsea remotely operated vehicles often incorporate hydraulic systems.

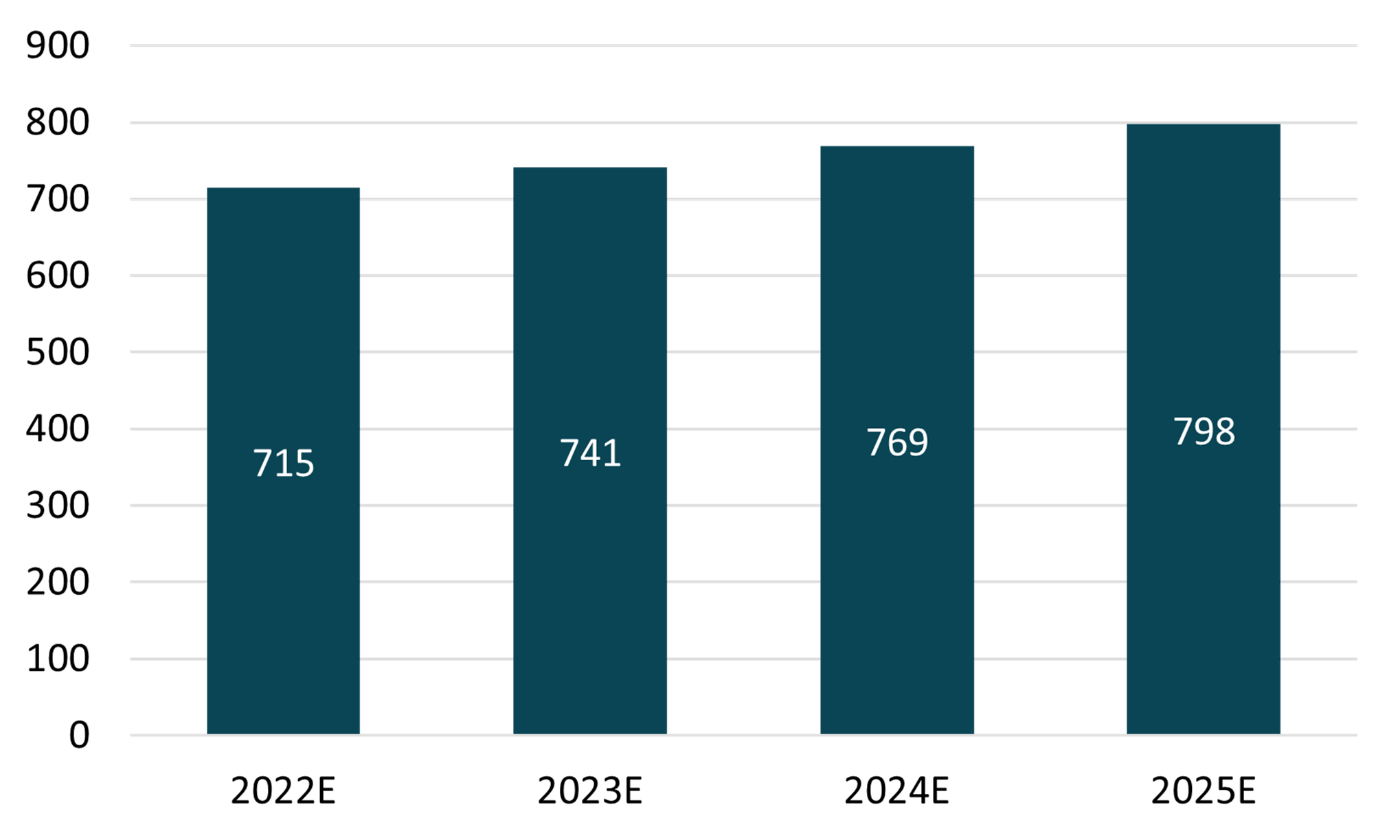

Market size

The global market for hydraulic manifolds is expected to grow at an annual growth rate (CAGR) of 3.7%, from US$ 689 million in 2021 to US$ 890 million in 2028.[1]

Demand Developments in key application areas

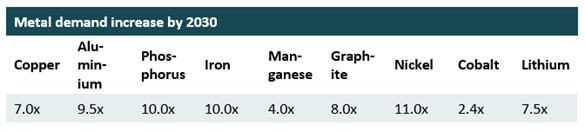

Mining

Demand for metals and minerals critical to the decarbonization process, dubbed the transition metals, is expected to increase immensely. The table below based on Australian Government’s Resources Technology and Critical Minerals Processing report[2], shows the extent of expected demand increase for transition metals. This equates to an increase in demand for mobile equipment required in both production and exploration activities.

Offshore & Marine

The demand for offshore & marine is expected to be driven by the buoyant market for oil rigs. Oil rigs are showing strong cash flow generation as energy prices have surged in the past two years. By the end of H1 2023, day rates for rigs were up 40% YoY with further increases seen for the rest of the year. This in association with increased rig utilization rates are expected to bolster the market for rigs, e.g. active floater utilization rates have rebounded from 2018 lows of 65% to over 85% today.[3]

Defense

Defense capital goods spending has surged in the aftermath of the Russian invasion of Ukraine. The trend looks to persist as multiple countries have recognized that they have insufficient capabilities to defend against a ground invasion. Insufficient capabilities are a result of defense under investment in the previous decades. For example, in the USA defense capital goods new orders showed 19.6 % YoY growth in May 2023[4]. For the Munich Security Conference held earlier in 2023, the conference report noted that the annual defense spending of EU member states in 2028 is expected to be around €258 bln, which is 43% above estimates made prior to the Russian invasion[5].

Market trends

Miniaturization and Integration

The trend of miniaturization and integration in hydraulic manifold design aims to create compact and efficient manifold designs. These developments are crucial for applications requiring hydraulic systems to be integrated into confined spaces, promoting better performance and overall control through streamlined fluid paths and simplified routing of hydraulic fluid.[6]

Customization and Digitalization

The demand for customized hydraulic solutions is driving innovation in the design and manufacturing processes of hydraulic manifolds. Digital tools, such as CAD software and simulation tools, are utilized to design and simulate hydraulic manifolds tailored to unique requirements. Additionally, digitalization trends like 3D printing technology are enabling the design of hydraulic manifolds with complex shaped structures and improved performance.[7]

Rise of Mobile and Off-Highway Equipment

The growth in mobile industries is propelling the demand for robust and reliable hydraulic systems. Hydraulic manifolds, critical components in these systems, are experiencing increased demand as mobile equipment demand is increasing in numerous key application areas, such as mining and defense.

Industry 4.0 and Automation

The advancement of Industry 4.0 has fostered the integration of hydraulic manifolds with digital control electronics, facilitating the shift of functions to software. This integration is crucial for optimizing hydraulic processes in automated factories and smart manufacturing environments, ensuring efficient fluid power distribution and control.[8] The trend is expected to persist as companies are keen on cutting high labor costs and automating labor-intensive processes as much as possible.

Sustainability

The global emphasis on sustainability is driving hydraulic manifold manufacturers to explore energy-efficient designs. Innovations aim at reducing energy consumption, minimizing leaks, and enhancing the overall eco-friendliness of hydraulic systems through advanced manifold designs that support sustainable practices. The key consideration here is that more sustainable products provide tangible benefits to OEMs. It has been recognized that industrial hydraulic systems achieve an average energy efficiency of 50%, while mobile hydraulic systems only achieve 21%, both results are far from optimal.[9]

Oskari Elojärvi

Analyst

[1] Business Research Insights: Hydraulic Manifold market report

[2] Australian Government: Resources Technology and Critical Minerals Processing, National Manufacturing Priority road map. https://www.australiaminerals.gov.au/__data/assets/pdf_file/0006/106449/resources-technology-and-critical-minerals-processing-national-manufacturing-priority-road-map.pdf

[3] Wood Mackenzie: Floating rig utilization rebounds to pre-COVID levels. https://www.woodmac.com/press-releases/floating-rig-utilization-rebounds-to-pre-covid-levels/

[4] OEM Off Highway August 2023 Equipment Market Outlook

[5] Defense Sitters: Transforming European Militaries in Times of War. Special Edition of the Munich Security Report on European Defense. June 2023. https://securityconference.org/assets/01_Bilder_Inhalte/03_Medien/02_Publikationen/2023/European_Defense_Report_-_Defense_Sitters/Defense_Sitters_European_Defense_Report_MSC.pdf

[6] Patel, Nimit. “Engineered-to-Order Mission Critical Hydraulic Manifolds Drive Overall Equipment Effectiveness of Fluid Power Systems.” ManufacturingTomorrow, 27 Jan. 2020.

[7] https://ieeexplore.ieee.org/document/9035877

[8] Patel, Nimit. “Engineered-to-Order Mission Critical Hydraulic Manifolds Drive Overall Equipment Effectiveness of Fluid Power Systems.” ManufacturingTomorrow, 27 Jan. 2020.

[9] https://iopscience.iop.org/article/10.1088/1742-6596/1087/4/042056/pdf#:~:text=1,integration%20and%20ease%20of%20maintenance