This market analysis provides an in-depth review of the wholesale of food, beverages, and tobacco market. The focus within this broad market is foodservice wholesale and further, wholesale to ethnic restaurants and pizzerias & hamburger and kebab restaurants.

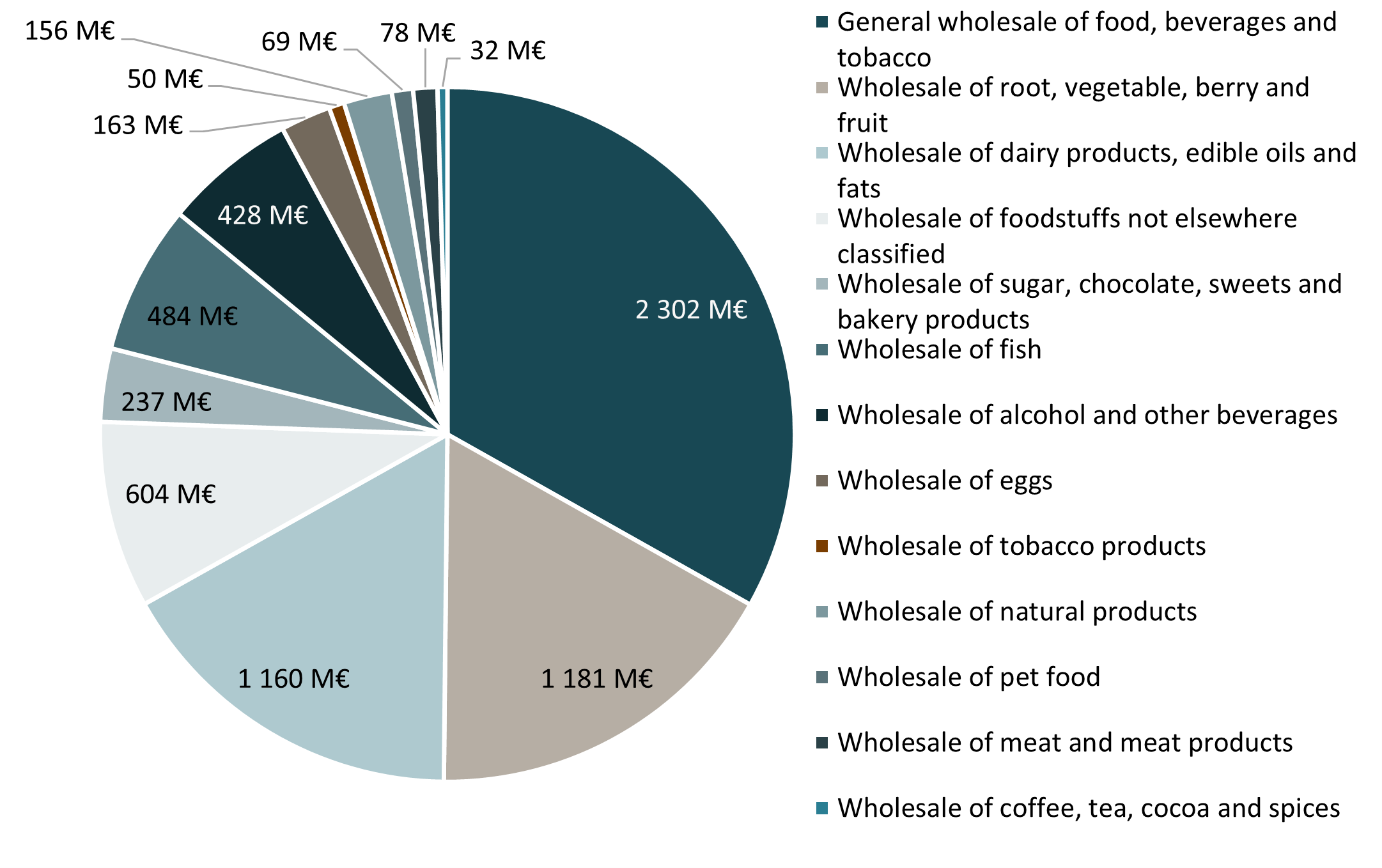

Wholesale of food, beverages and tobacco in Finland

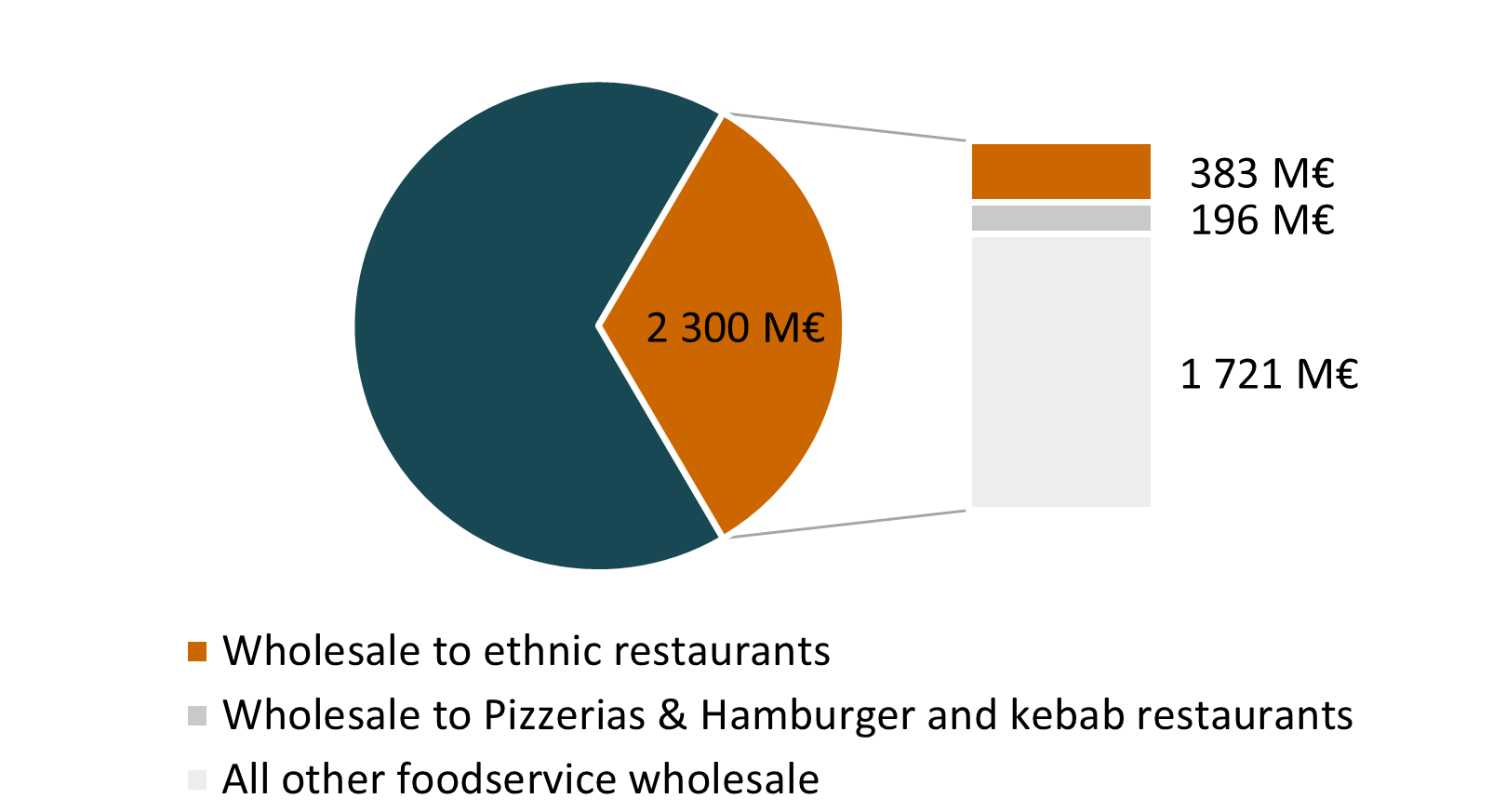

The wholesale of food, beverages and tobacco market in Finland is estimated to be worth 6.9 B€, which is based on 846 companies’ turnover that has the Tol 2008 code 463 (wholesale of food, beverages and tobacco)[1]. This market comprises companies that serves both retail stores and operators outside retail trade.

Foodservice wholesale

Foodservice wholesaling is an important part of the overall service provided by the grocery and convenience goods trade. It is responsible for the distribution of goods outside retail trade.

Foodservice wholesaling can also be referred to as HoReCa wholesaling, which refers to the main target market of the sector with the HoReCa acronym meaning Hotels, Restaurants and Catering.

The foodservice wholesale market is estimated to be worth 2.3 B€[2] in 2023. The food market in Finland is expected to grow at a CAGR of 4.1 % from 2023 to 2028[3], making the market worth 2.8 B€ in 2028.

Foodservice wholesale to ethnic restaurants

Sushi, Nepalese, Chinese and Indian restaurants are examples of ethnic restaurants. One in six or 17% of the restaurants in Finland are ethnic[4], leading to a market size worth 383 M€ in 2023 of the foodservice wholesale to ethnic restaurants in Finland. With the same CAGR of 4.1% as the foodservice wholesale, the market will be worth 468 M€ in 2028.

Foodservice wholesale to pizzerias & hamburger and kebab restaurants

In Finland, there are approximately 16150 professional kitchens, or HoReCa establishments, which serve roughly 749 M meals to customers every year[5]. From this, 8.5 % of the restaurants are hamburger and kebab restaurants, and pizzerias[6]. The foodservice wholesale to pizzerias & hamburger and kebab restaurants market in Finland was worth 196 M€ in 2023. With the same CAGR of 4.1%, the market will be worth 240 M€ in 2028.

The wholesale of food, beverages and tobacco market is consolidated

The market is highly consolidated, with the top ten biggest companies accounting for 45% of the €6.9 billion market. The remaining 800+ companies represent the other 55% of the market.[7]

The foodservice wholesale sector is marked by considerable competition and encompasses three main types of distributors: broadline, systems, and specialty. Broadline distributors provide an extensive assortment of products, including both fresh and frozen foods, dry goods, and various non-food items. They cater to a wide array of clients, including everything from independent restaurants to healthcare institutions.

Systems distributors primarily align with specific restaurant chains, offering tailored product assortments to suit the demands of these entities. Additionally, specialty distributors are concentrated on certain food product categories like seafood, gourmet, or organic items, targeting distinct market segments.

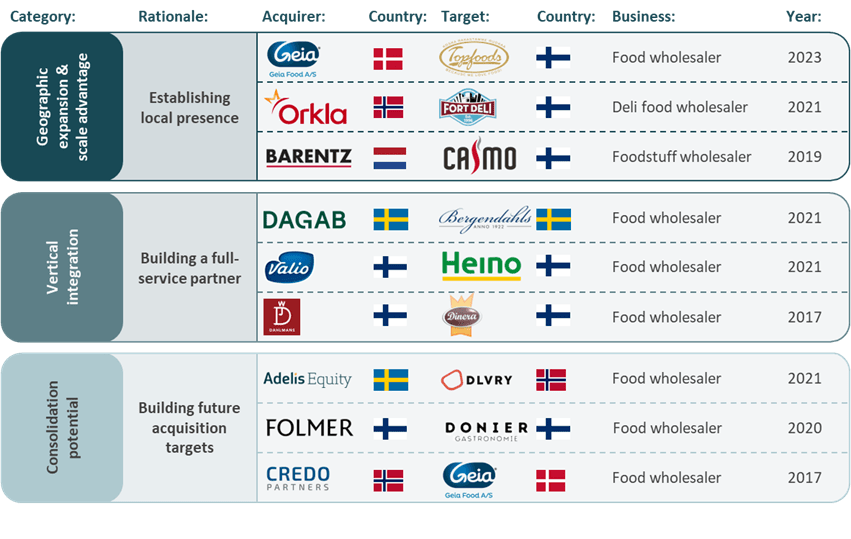

Market dynamics favor non-organic growth strategies to enable faster scaling

Selected M&A deals

Categories explained:

- Large entities are actively searching for niche players within specialized markets that require complex, challenging-to-acquire expertise.

- Buyers aim to evolve into full-service providers by adopting vertical integration strategies, thereby improving cross-selling opportunities, customer retention, and entry into new markets.

- Consolidators and private equity firms are actively consolidating the market by acquiring and developing mid-sized companies into larger entities, with the ultimate goal of selling these enhanced businesses to larger industrial operators or other buyers.

Growth drivers and trends

The food industry, noted for its resilience, consistently experiences robust demand for lunch and economically priced dining establishments. This trend, except for a temporary decline during the pandemic due to mandatory lockdown measures, has remained strong. Within the broader food sector, the segment comprising affordable dining options is particularly steadfast. It is anticipated that the demand for lunch restaurants and cost-effective dining alternatives will continue to exhibit strength in the future.[8]

The current consumer trends in the beverage and food sectors, including the growing consumption of nonalcoholic drinks, the sustained popularity of coffee, and the consistent demand for carbonated soft drinks, highlight shifts in consumer preferences. Moreover, the rising preference for meat alternatives and plant-based products, such as dairy substitutes, points to a movement towards healthier and more sustainable eating habits. These evolving consumer trends are crucial catalysts for growth, as they directly impact the product mix offered and the marketing approaches in the foodservice wholesale market.[9]

The sectors of e-grocery and meal delivery services are projected to experience moderate growth. Notably, the meal delivery market is showing more rapid growth compared to e-grocery. A key objective in these online services is to attain profitability, with certain operators nearing or achieving a break-even status. The distinction between online and offline channels is gaining importance, emphasizing the necessity for robust offerings in both areas.[10]

The Nordic foodservice industry is currently experiencing a surge in investment needs, especially in areas like technology, digitalization, IT enhancements, and automation. This trend is partly fueled by the necessity to align with consumer demands for sustainable practices and the digital transformation of retail. Such investments are essential for enhancing operational efficiency and maintaining competitiveness in a swiftly changing market environment.[11]

In the current market, big players in the foodservice and grocery industries are actively engaging in M&A to attain economies of scale. This strategic consolidation is primarily motivated by the necessity to efficiently control costs and utilize size advantage during supplier negotiations and technological advancements. Concurrently, smaller companies are seeking scale through methods such as collective purchasing or establishing collaborative ventures for shared investments.[12]

Nico Henriksson

Associate

[1] Taloustutka database: Tol 2008 463; NG research

[2] Foodservice-tukkukauppa, PTY (2023)

[3] Food – Finland: Statista (2023)

[4] Ulkomaalaistaustaiset ravintolat valtaavat maata – etenkin pääkaupunkiseutua, StatFin (2011)

[5] Foodservice-tukkukauppa, PTY (2023)

[6] Finnish Food Industry Statistics, Ruokatieto 2019

[7] Taloustutka database: Tol 2008 463; NG research

[8] NG research

[9] 5 Nordic consumption trends to watch: NIQ (2022)

[10] State of grocery Europe 2023: Living with and responding to uncertainty: McKinsey & Co. (2023)

[11] State of grocery Europe 2023: Living with and responding to uncertainty: McKinsey & Co. (2023)

[12] State of grocery Europe 2023: Living with and responding to uncertainty: McKinsey & Co. (2023)