This market overview focuses on global pharmaceutical advertising and marketing and the underlying global market of pharmaceuticals. The global pharmaceutical market size was estimated at €1 063 billion in 2021 and it is expected to grow 9.5% annually, driven mainly by an aging population and increasing prevalence of lifestyle-related diseases.

The pharmaceutical advertising and marketing market is set to grow faster than the underlying pharma market (12.3% annually) due to increasing competition between pharmaceutical companies and the shift from in-person to digital sales. The current size of the global pharma-advertising market is estimated at €29 billion.

Pharmaceuticals are a highly regulated industry where players must comply with regulations at every step of the product life cycle. The governing bodies[1] regulate the research, pre-clinical phase, registration phase, clinical trials, processing, manufacturing equipment, instrument validation, quality maintenance, packaging, labeling, marketing, and more.[2]

In the EU, a common EU legislation governs practically all steps of the medicinal product life cycle, a notable exception being retail distribution, which is governed by national legislation of member states. The wholesale of drugs, in turn, is governed by EU legislation.[3]

The research and development, which includes drug discovery and design, pre-clinical phase, and clinical trials, is extremely time- and resource-consuming as it typically takes circa 10 to 14 years from the initial discovery to the end of clinical trials (i.e., end of Phase III). The average cost of creating a new drug has been estimated to be as high as $2.6 billion. The regulatory approval from the regional regulatory body typically takes 1 to 2 years, and after receiving approval, the companies can start manufacturing the medicine.[4]

Simplified pharmaceutical product life cycle:[5]

1.1 The Global Pharmaceutical market is set to continue fast growth due to ageing population

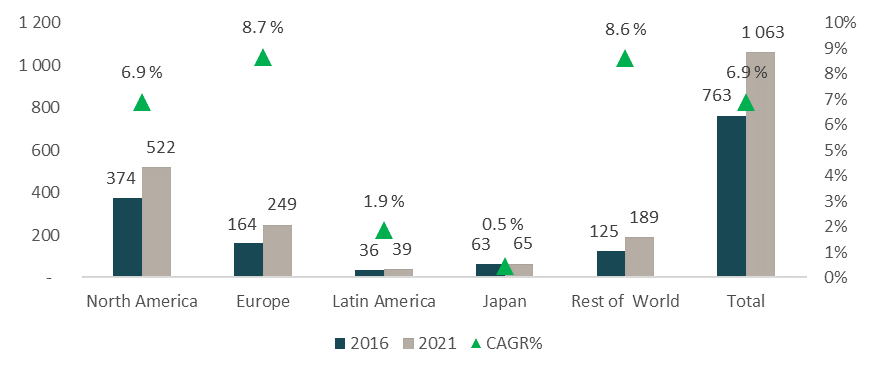

The Global Pharmaceutical Market size 2016-2021 (€ billion):

The global pharmaceutical industry is a trillion-euro industry with an estimated value of €1 063 billion in 2021 at ex-factory prices[6], up from €763 billion in 2016, showing an annual growth of 6.8%. North America is the largest pharmaceutical market, with a size of €522 billion in 2021 (49% of the Global markets), followed by Europe with €249 billion (23%). Europe and Rest of the World were the fastest-growing regions from 2016 to 2021, with an annual growth rate of 8.7% and 8.6%, respectively.

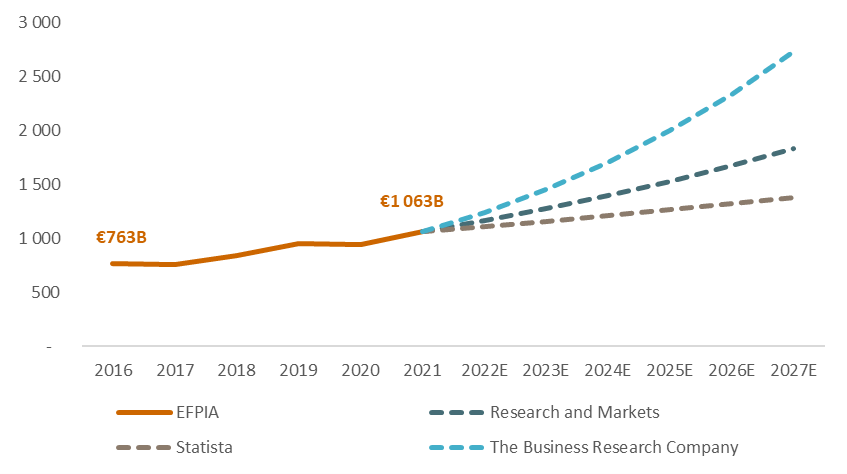

The Global Pharmaceutical Market size and growth forecasts (€ billion):[7]

The growth in the pharmaceutical market is expected to continue, but market research companies forecast varying growth rates in the upcoming years. The Business Research Company is at the higher end of the forecasts, with an annual estimated growth rate of 17.1% for the following years. Research and Markets forecasts a growth of 9.5%, while at the lower end of the forecasts, Statista expects the market to grow by 4.5% annually.[8]

While the forecast growth range is vast, with global market size estimates varying from €2 738 billion to €1 383 billion in 2027, the market is expected to grow faster than the global economy. The market is driven by the ageing of the population, a decline in physical activity, and unhealthy eating and drinking habits.[9] By 2030, globally, 1 in 6 people will be at least 60 years old, which means that the number of people over 60 will increase from 1 billion in 2020 to 1.4 billion by 2030. In 2050, the number of people in the same age group is expected to double to 2.1 billion, and the number of people at least 80 years old will triple and reach 426 million in 2050.[10] The rise in the elderly population increases the patient pool for many chronic diseases, driving up the demand for pharmaceuticals.

Looking into the drug segments, prescription drugs dominate the market with 87.7% forecasted 2023 share of the global market of 87.7%, compared with 12.3% for OTC drugs.[11] Grandview Research estimates that long term 35% of the value of the European drug market comes from generic drugs and 65% from branded drugs.[12]

1.2 The Nordic pharmaceutical advertising market is estimated at €350 million in 2021

Like healthcare and pharmaceutical markets, pharmaceutical advertising and marketing are strictly regulated by local legislative bodies. Promotion of medicinal products, i.e., how pharmaceutical products can be marketed directly to consumers and healthcare professionals, is governed by top-level advertising laws and regulations in the European Union. The member states have adopted the European directives into their domestic laws and regulatory guidelines, which has led to further localized measures that regulate pharmaceutical marketing. Pharmaceutical marketing activities can be monitored and controlled either by the government or national competent authority. This national-level “self-regulation” framework enables localized guidelines, which allows different marketing practices between the European countries.[13]

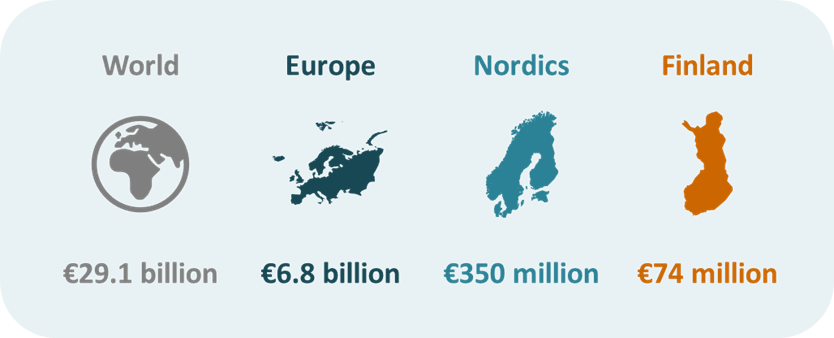

The Pharmaceutical Advertising and Marketing market sizes 2021:[14]

The global pharmaceutical marketing market size is estimated at €29.1 billion in 2021, which corresponds to circa 3% of the size of the global pharmaceutical market. Assuming the marketing spend is constant across global regions, we can estimate the European pharmaceutical advertising market to be €6.8 billion, the Nordic market to be €350 million, and the Finnish market €74 million in value in 2021.

The global pharmaceutical advertising market is expected to double from €29 billion in 2021 to €58 billion by 2027, growing 12.3% annually. The growth in the pharmaceutical advertising market is driven by the development of the underlying pharmaceutical product market, the shift from in-person sales representatives to digital marketing channels, and rising competition in the healthcare industry.[15]

The shift from in-person sales to digital marketing channels results from changing doctors’ attitudes, with fewer of them allowing for in-person sales meetings and more of them engaging in digital marketing. The trend toward digital marketing channels is expected to continue gaining popularity when younger doctors rise in the ranks and older generations retire.[16] The increasing number of alternatives for the patients to choose from makes competition for customers more challenging, and increased emphasis on marketing offers a way to stand out from the competition.[17]

The pharmaceutical advertising is an attractive niche within the broader Finnish advertising market

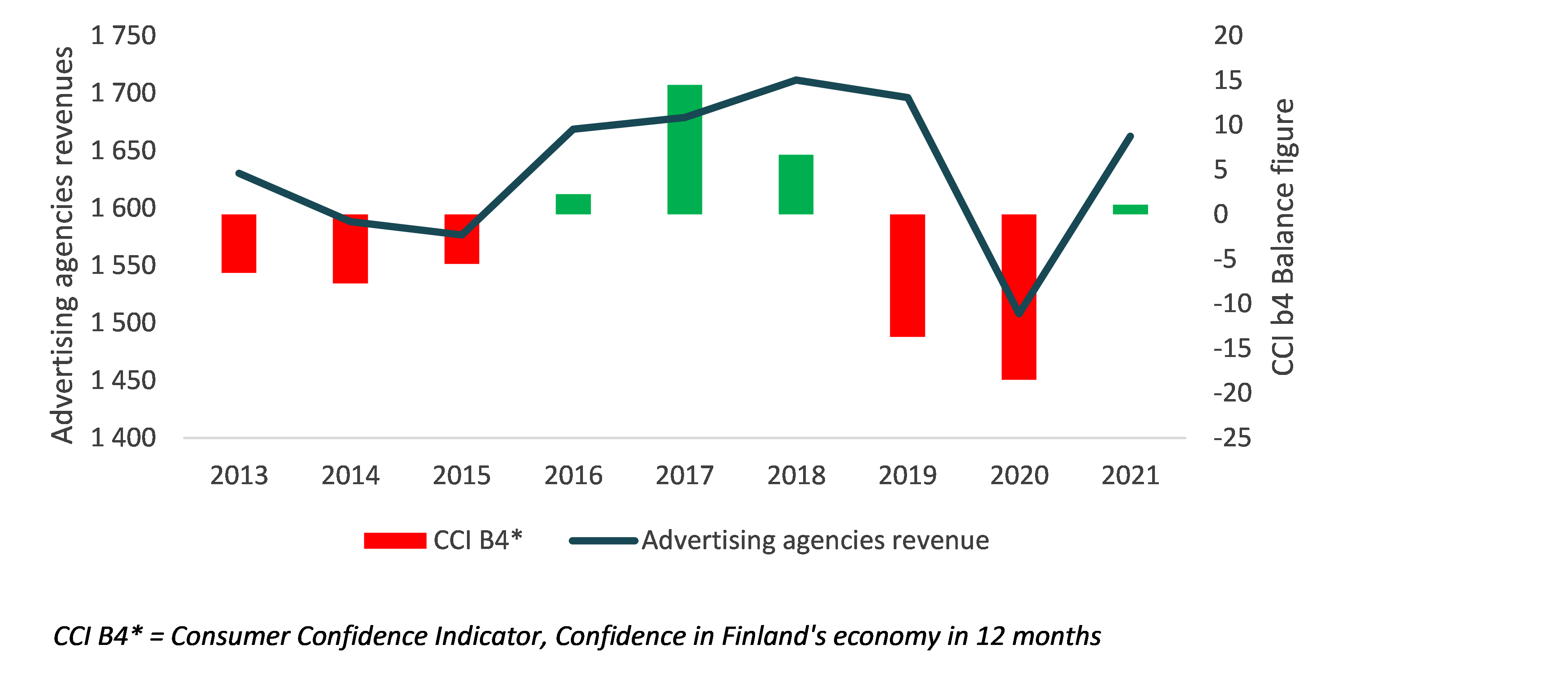

Marketing and advertising are typically regarded as activities that get cut first when a company anticipates a decrease in demand due to a looming recession or a slowing down in general economic activity. Therefore, the market is driven by public sentiment in the economy. This market characteristic is visible in the graph below, where the combined annual revenues of the Finnish advertising agencies move together with the Finnish consumers’ confidence in the Finnish economy in 12 months.

The Finnish Advertising Agencies’ revenues vs Consumer Confidence 2013-2021[18]:

Compared to the broader advertising and marketing industry, the pharmaceutical and healthcare advertising industry has been considerably more stable and has grown faster, attributing to different market drivers, i.e., growth of the underlying healthcare and pharmaceutical market and the increasing shift from in-person to digital marketing among pharmaceutical companies.

Market summary

The pharmaceutical advertising market is estimated globally at €29 billion in 2021 and to reach €58 billion by 2027, growing 12.3% annually. The Finnish pharmaceutical advertising market is estimated at €74 million. The growth in pharmaceutical advertising is driven by the growth in the underlying pharmaceutical market, the shift from in-person sales to digital marketing among pharmaceutical companies, and the increasing number of alternatives for patients. Compared to the broader advertising industry, the pharmaceutical and healthcare advertising industry is less affected by economic cycles, thanks to different market drivers.

Aleksi Pulkkinen

General Manager

[1] e.g., FDA (Food & Drug Association) in the US, EMA (European Medical Agency) in Europe, PMDA (Pharmaceuticals and Medical Devices Agency) in Japan.

[2] Product Lifecycle in Pharmaceutical Industry: Journey of Drug from Ideation to Commercialization.

[3] Thomson Reuters: Practical Law: Distribution and marketing of drugs in the EU: overview.

[4] N-Side: What’s the average time to bring a drug to market in 2022? Product Lifecycle in Pharmaceutical Industry: Journey of Drug from Ideation to Commercialization.

[5] Modified from: Product Lifecycle in Pharmaceutical Industry: Journey of Drug from Ideation to Commercialization.

[6] Ex-factory price (price set at the level of the manufacturer).

[7] The graph displays the Global Pharmaceutical Market size in billion euros for 2016-2021, and estimated market size using forecasted growth rates from 3 market research companies. Sources: EFPIA: Pharmafigures 2017-2022; Research and markets: Pharmaceutical Drugs Global Market Report 2022; Statista: OTC Pharmaceuticals – Worldwide; Statista: Prescription Drugs – Worldwide; The Business Research Company: Pharmaceuticals Global Market Report 2022.

[8] EFPIA: Pharmafigures 2017-2022; Research and markets: Pharmaceutical Drugs Global Market Report 2022; Statista: OTC Pharmaceuticals – Worldwide; Statista: Prescription Drugs – Worldwide; The Business Research Company: Pharmaceuticals Global Market Report 2022.

[9] Statista: OTC Pharmaceuticals – Worldwide; Statista: Prescription Drugs – Worldwide; The Business Research Company: Pharmaceuticals Global Market Report 2022.

[10] WHO: Ageing and health.

[11] Statista: OTC Pharmaceuticals – Worldwide; Statista: Prescription Drugs – Worldwide.

[12] Grandview Research: Europe Pharmaceutical Market Size, Share & Trends Analysis Report By Product.

[13] BlueReg Group: Pharmaceutical advertising regulations in Europe: Responsible Persons, 2001.

[14] EFPIA: Pharmafigures 2017-2022; ReportLinker: Pharmaceutical Marketing Market Research Report by Type (Conference Marketing, PPC Advertising, and Print Advertising); Nordic Growth.

[15] Market Data Forecast: Global Healthcare Advertising Market Size, Share, Trends, COVID-19 Impact & Growth Analysis Report; Informa: Driving Efficiency in Pharma Marketing.

[16] Informa: Driving Efficiency in Pharma Marketing.

[17] Market Data Forecast: Global Healthcare Advertising Market Size, Share, Trends, COVID-19 Impact & Growth Analysis Report.

[18] Suomen virallinen tilasto (SVT): Yritysten rakenne- ja tilinpäätöstilasto [verkkojulkaisu]; Official Statistics of Finland (OSF): Consumer Confidence [e-publication].