This market overview delves into the retail sales of tires market in Finland, with a specific focus on the market for tires and rims, tire hotels, and tire changing services. To estimate the market size in Finland, we employ a set of assumptions, including data from Statistics Finland on the number of registered cars in 2022 and industry analysis.

Market Size Assumptions

- Cars: In Finland, there were approximately 3 673 750 registered cars in 2022[1].

- Lifetime: The average lifetime of tires and rims is approximately 5 years, indicating that consumers typically purchase new tires and rims every five years.[2]

- Average Price of Tires: The average price for one set of tires in Finland is estimated to be €400.

- Average Price of Rims: Similarly, the average price for one set of rims is estimated to be €600 in Finland.

- Tire Hotel Price: The cost of a tire hotel service for a full year, including two seasons, is approximately €190 in Finland.

- Tire Mounting Price: The cost of mounting one set of tires for consumers is roughly €50 in Finland.

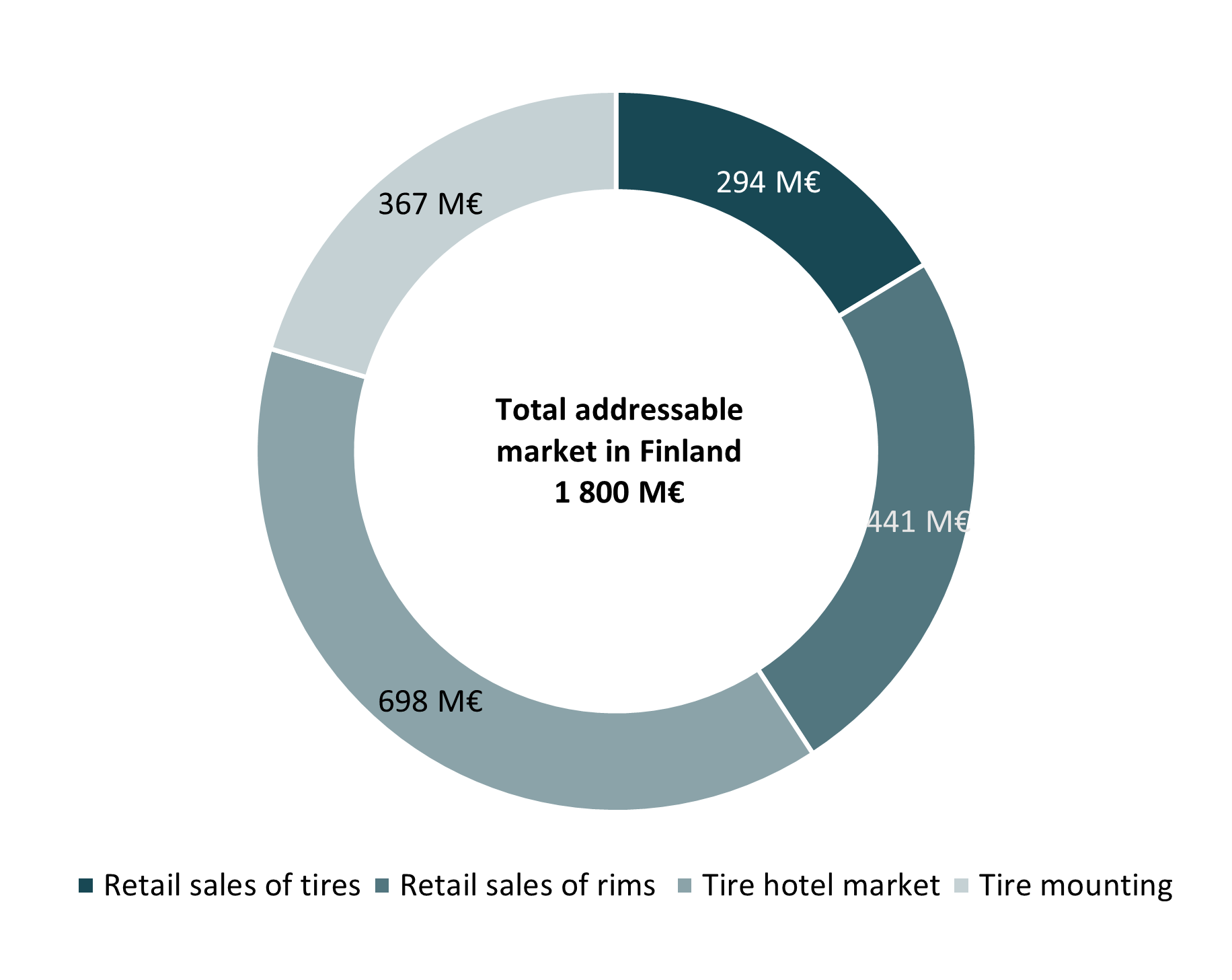

The total addressable market in Finland

The graph presents the market values in Finland in 2023 and 2033. The market is projected to grow at a Compound Annual Growth Rate (CAGR), of 6.5%[3] from 2023 to 2033.

The market sizes in Finland are derived using the assumptions mentioned earlier. The retail sales of tires are calculated by multiplying the number of cars in Finland by the average price of one set of tires. To account for the fact that consumers don’t purchase new tires every year, this number is divided by 5, reflecting the average tire lifetime. The same methodology is applied to estimate the retail sales of rims.

The tire hotel market represents the sector for storing winter or summer tires when not in use, including the cost of storage and tire mounting during the season. The average price for the two seasons in a tire hotel is approximately €190, and the potential market size is determined by multiplying this price by the number of cars.

Changing tires incurs a one-off cost for consumers twice every year (changing from summer to winter tires and vice versa), estimated at around €50 for one set of tires. The market value is therefore determined by multiplying the price by the number of cars.

Growth drivers and trends

The demand for automotive tires and rims remains consistently high, with their significance further underscored by the increasing prevalence of electric vehicles. Electric cars are equipped with specialized rims incorporating sensors that continuously monitor tire pressure and provide timely feedback to drivers when adjustments are required. This trend is not limited to electric vehicles alone; it is also contributing to the expansion of the automotive industry, particularly in the realm of tire and rim manufacturing and services.[4]

The enhanced durability and construction of modern vehicles have prompted consumers to retain their vehicles for extended durations. Consequently, there has been a noticeable increase in the demand for automotive replacement components, notably tires, aimed at preserving and servicing these vehicles. As vehicles are now in use for longer periods, routine maintenance and tire replacements have become imperative, thereby driving up the demand for tires.[5]

The rising disposable income among consumers is fueling an uptick in demand for larger-capacity vehicles, such as SUVs and crossover vehicles. Larger vehicles inherently come with bigger tires, consequently driving an increased need for tire storage facilities or tire hotels as well as tire changing services.[6]

The prevailing global economic conditions have precipitated a change in tire purchasing behavior. Customers are transitioning from pricier tire brands to more budget-friendly yet high-quality alternatives. This shift has been a noticeable feature in the market for the last 15 years, and it appears to be gathering further momentum in the current economic landscape. Additionally, there has been a notable reduction in the disparities in tire quality, concomitant with an expansion in the range of available prices.[7]

Nico Henriksson

Associate

[1] Statistics Finland

[2] Do Car Rims Wear Out?: Carpart (2021) & Automotive Tires Market Outlook: FMI (2022)

[3] Automotive Tire Market Outlook (2023 to 2023): FMI (2023) & Automotive Wheel Rims Market: FMI (2023)

[4] NG research

[5] Automotive Tire Market: Technavio (2023)

[6] NG research

[7] NG research