Augmented reality (AR) refers to the technology that allows overlaying 3D virtual objects into a real-world environment. A related concept, Virtual Reality (VR), differs from AR in that it creates a completely virtual environment with virtual objects. AR and VR are subareas of a broader concept, Extended Reality (XR). This market overview focuses on the AR market in general, and the AR e-Commerce enablement industry in particular.

The 3D/AR technology adoption is growing rapidly

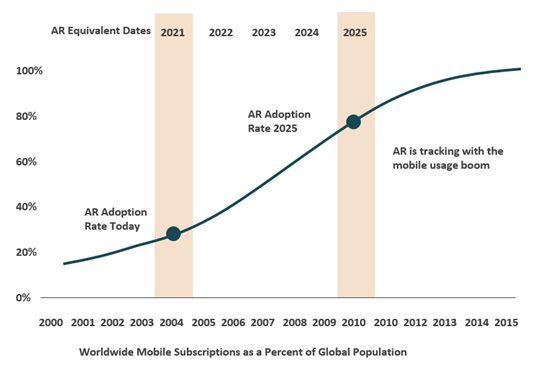

The 3D/AR technologies are still in early stage of adoption and the adoption rate is expected follow a rate comparable to what was experienced in mobile phones in the years 2004 to 2010[1]. The adoption rate will be driven by technological advancements in the space. 3D/AR related yearly patents in the US grew to more than threefold between 2009 and 2019[2], which is one manifestation of the pace of innovation in 3D/AR. Future developments in 5G technology can be expected to further accelerate the adoption rate, as 5G offers increased download speed[3].

Mobile phone vs. AR adoption rates[4]:

The 3D/AR technologies are expected to have practical applications in multiple fields in the future. In addition to the most obvious applications of 3D/AR technologies, e-commerce and entertainment, the possible use cases for 3D/AR include for example, such fields as education, healthcare, architecture, and navigation as the technology matures. Statista estimates the total market size of XR to be $31 billion in 2021 and to grow to over $300 billion by 2028[5].

AR e-Commerce enablement industry expected to reach $1 billion in 2024

3D/AR technology has practical use cases in e-commerce and online shopping. The 3D/AR features offer an immersive shopping experience with 3D visualizations, virtual try-ons and product demos. 3D/AR technology provides a consumer with the possibility to “try” the product before buying it, thus reducing return rates significantly. The global value of retail e-Commerce in 2022 is estimated at $5 700 billion and to reach $8 100 billion by 2026, growing 9,3% annually[6].

It is estimated that only 48% of returned products can be sold again at full price[7]. The issue related to product returns is more pronounced in e-commerce, where the return rate is estimated at 25%-40% compared to 8% at brick-and-mortar stores[8]. Based on the estimated return rate and the size of the retail e-Commerce market, we can estimate the 2022 value of returned online purchases to be in the range of $1 400 – 2 300 billion.

E-commerce customers value flexible shipping and return policies highly. According to Deloitte[9], 74% of customers would be deterred to make a purchase due to shipping fees on returns, thus, reducing item returns via stricter return policies is not appealing to online stores. 3D/AR can be used to address this issue by offering customers a more immersive online shopping experience with the use of 3D images and virtual try-ons. According to ARtillery, e-tailers have reported decreases in return rates up to 40% after implementing 3D/AR-features to the online shopping experience[10].

Another benefit of the use of 3D/AR in e-Commerce is increased session durations and conversion rates. According to Snap[11] the conversion rate lifts by 94% when a product has 3D/AR features that consumers can interact with.

Estimate of the AR influenced e-Commerce market size, M$[12]:

The AR-influenced e-Commerce is expected to grow to a $33,5 billion industry by 2024 with a CAGR of 129%, boosting the growth of the 3D/AR e-Commerce enablement industry, still a nascent industry but expected to reach almost one billion USD by 2024[13]. As discussed above, the main drivers for the market are the growth in e-Commerce, the investment pace and maturing of 3D/AR technologies and the concrete benefits of AR to online retailers.

Tech giants are actively acquiring AR/VR companies

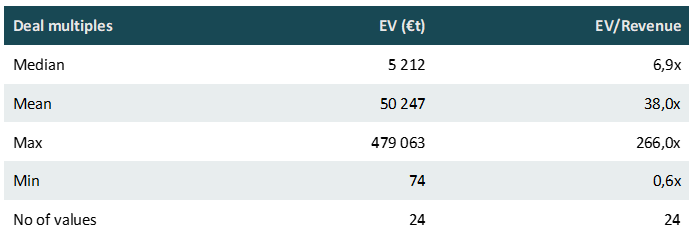

A sample of the acquisitions in the broader AR/VR industry covers 24 transactions with known multiples. The median enterprise value to sales -multiple in the sample was as high as 6,9x, and the average 38,0x. In addition to the high valuations seen in the recent transactions, another interesting feature is a substantial deviation in them.

High valuation multiples tell us that the companies in the industry agree with the exponential growth expectations for the AR/VR market, projected by market research companies.

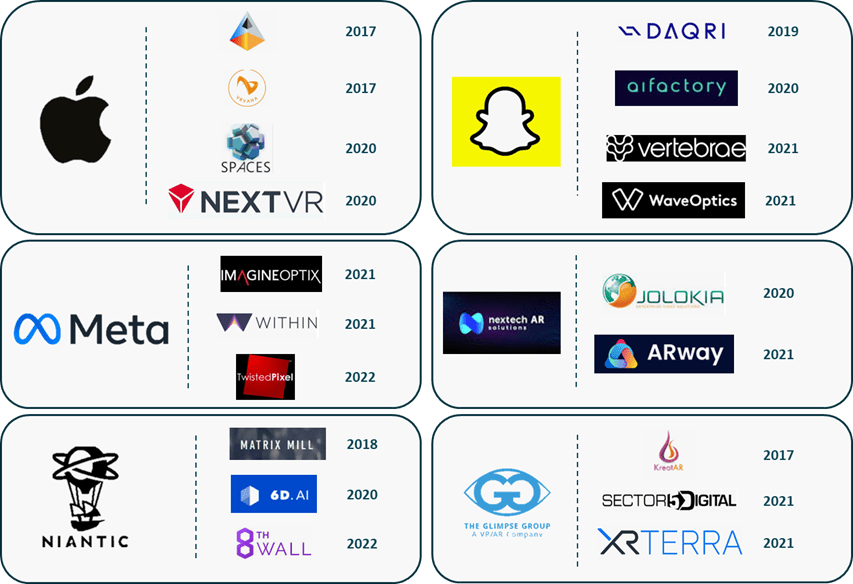

Tech giants such as Apple and Meta are among the most active players acquiring targets from the AR/VR industry as they seek plug-and-play solutions to be implemented to their existing products and platforms and to acquire companies with cutting edge VR/AR technologies that benefit from access to resources provided by the large players.

Selected examples of M&A activity in AR/VR industry[14]:

Matti Kari

Associate

[1] Snap Inc.: Consumer AR Global Report 2021

[2] Deloitte Insights: The Spatial Web and Web 3.0

[3] Snap Inc.: Consumer AR Global Report 2021

[4] Snap Inc.: Consumer AR Global Report 2021

[5] Statista: Extended reality (XR): AR, VR, and MR – statistics & facts

[6] Statista: Retail e-commerce sales worldwide from 2014 to 2026

[7] LogisticsMatter: All You Need to Know About-eCommerce Returns in Europe; MarketWatch: Consumers return $642,6 billion in goods each year

[8] LogisticsMatter: All You Need to Know About-eCommerce Returns in Europe

[9] Deloitte: Bringing it back

[10] ARtillery Excerpts: Does AR Really Reduce eCommerce Returns?

[11] Snap Inc.: Consumer AR Global Report 2021

[12] ARtillery Intelligence Briefing: AR Advertising Deep Dive, Part II: Case Studies

August 2020

[13] ARtillery Intelligence Briefing: AR Advertising Deep Dive, Part II: Case Studies

August 2020

[14] NG analysis