The construction industry is currently facing challenging times, with economic uncertainties and rising interest rates dampening its growth and potential. However, in every downturn lies the potential for resurgence. To bounce back from its current lows, the construction industry needs help from stabilizing interest rates and better economic expectations, but it also needs to proactively address key development areas, including fostering collaboration, and prioritizing sustainability.

Overview of the Finnish construction industry

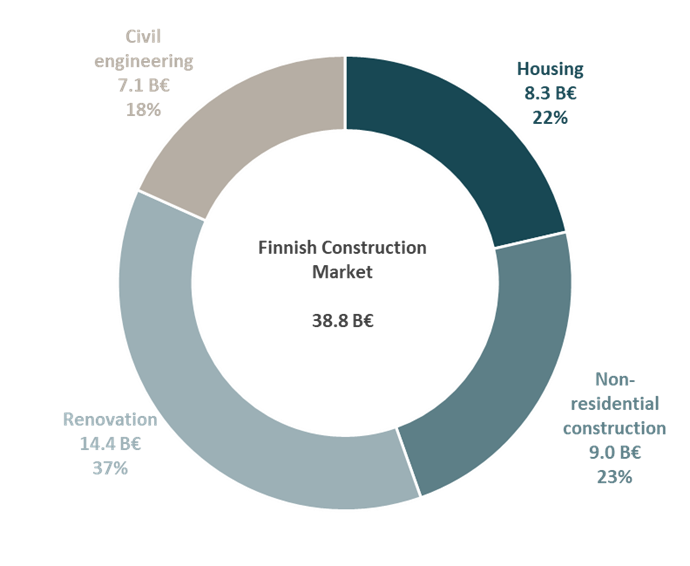

The construction industry in Finland was valued at 38.8 B€ in 2021. The industry grew 1.3 % in 2022 but is estimated to decline by 3.5 % in 2023 and by 0.5 % in 2024. The short-term outlook is affected by several factors including inflation, constraints on supply chains, shortage of labor, increasing raw materials costs and high interest rates. Historical stable growth is over, scarcity and disruptions in supply shake the market and corrode societies and decision making.[1]

Total construction market value in 2021[2]

The housing market will decline the most during 2023 and 2024. The number of housing project starts is decreasing strongly due to the higher-than-expected increase in interest rates and high inventory levels on the supply side. The housing market is therefore projected to decline by up to 20 % in 2023 and further 10 % in 2024.

Non-residential construction and renovation, on the other hand, have better short-term projections. Non-residential construction is projected to grow by 1 % in 2023 and 1.5 % in 2024 while renovation is projected to grow by 1.5 % and 2 % in 2023 and 2024, respectively. Green transition, economic growth and cost development support non-residential construction while construction cost increases and the slowdown in new construction speed up repairs support renovation.

The civil engineering market is projected to decline by 2 % in 2023 due to slowdown in road and rail construction. However, 2024 looks brighter as the market is projected to grow 1 % because of slowing cost development supporting new projects.

Housing production is declining below average annual need

According to VTT, a total of 700,000 new apartments will be needed over the next twenty years, i.e., 35 000 new apartments per year. 90 percent of the need is directed to the fourteen largest urban regions in Finland and the Helsinki region’s share is half of the need. The projection now is that ~27 000 new apartments will start to be built in 2023 and ~31 000 new apartments will start to be built in 2024, which is well below the need.

Construction industry seeks changes to government-supported housing construction (ARA) to speed up the recovery of housing construction[3]:

- Accepting elevated costs during exceptional circumstances: Unclear interpretations of the law regarding whether construction costs exceeding the normal limits of Ara projects can be permitted in the current exceptional situation are hindering new Ara projects, particularly in the capital region.

- Temporarily reducing the self-liability portion of interest subsidy: With interest rates rapidly increasing, interest subsidies play a crucial role in facilitating housing production.

- Enabling the transfer of financial authorization between different project types: Since 2016, a more flexible 10-year interest subsidy model has been available for rental housing construction in addition to the 40-year interest-subsidized loan. The model has been underutilized during periods of zero interest rates but is now needed due to the challenges in privately financed rental housing production.

- Develop tools and a financing model to ensure repair grants: The rising costs and interest rates not only impede new construction but also hinder renovation projects and energy retrofits in Ara housing and other residential buildings.

General keys to regaining momentum in the construction industry

In addition to the expected improvement in economic expectations, continued standardization of construction materials and requirements within EU would reduce material costs and streamline construction. Also, domestic construction regulation would need to be streamlined and simplified. Somehow the regulators and industry should challenge the current thinking that if regulation is good, then more regulation is better.

Continued efforts to improve quality and make construction more efficient are also needed. Collaboration among contractors, subcontractors, architects, engineers, and suppliers is pivotal for recovery. Open communication and strong partnerships lead to shared expertise, streamlined workflows, and cost optimization[4]. Collaborative project management platforms facilitate real-time collaboration and transparent decision-making, improving project outcomes and client satisfaction.

Green practices and sustainability are also essential for recovery. Adhering to green building standards, utilizing renewable energy, efficient waste management, and sustainable materials attract environmentally conscious clients and align with regulations[5]. Sustainable practices reduce environmental impact, cost, and operational efficiency.

Investing in upskilling and workforce development is also important. Technological advancements require a skilled workforce. Training programs, apprenticeships, and certifications equip employees with necessary skills for a digitally driven industry[6]. Collaborations with educational institutions bridge the skills gap and attract new talent.

Furthermore, improving risk management and building resilience protect projects from disruptions and minimize financial losses[7]. Safety protocols, contingency plans, and resilient construction practices enhance durability and long-term value.

Nico Henriksson

Associate

[1] Suhdannekatsaus 1/2023: Rakennusteollisuus RT (2023)

[2] Suhdannekatsaus 1/2023: Rakennusteollisuus RT (2023)

[3] Suhdannekatsaus 1/2023: Rakennusteollisuus RT (2023)

[4] Construction Executive: “The Importance of Collaboration in Construction”

[5] World Green Building Council: “Advancing Net Zero: Low Carbon Embodied Materials in Construction”

[6] National Center for Construction Education and Research: “Workforce Development Programs”

[7] Engineering News-Record: “Building Resilience into Construction Projects”