This market overview examines two distinctive but closely related markets: the first section concentrates on the European market for freight transportation by road and the second section on manufacturing of bodies for motor vehicles.

The freight transportation market is used as a proxy for sizing the market for manufacturing of bodies, primarily since the end-client is deemed similar for both markets. The main market growth driver is an increase in demand for cross-border retail and e-commerce transportation within Europe. In addition, growth in production of light commercial vehicles, buses, heavy trucks, and passenger cars have contributed to the increased demand for motor vehicle body manufacturing.

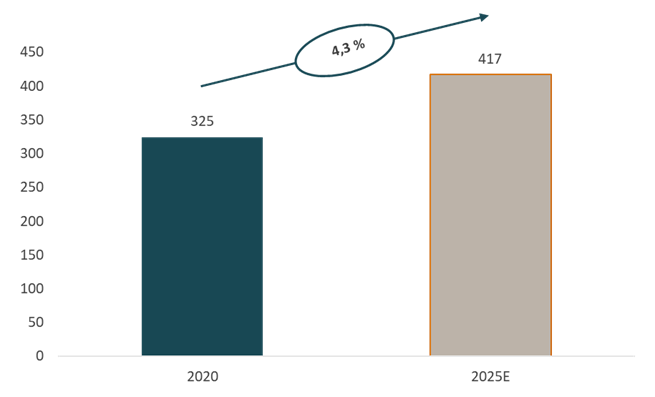

The European freight transportation market by road was valued at 325 B€ in 2020

The industry for freight transportation contains all transport of goods, such as timber, animals, heavy goods, bulk goods, waste & waste material and refrigerated transport.

The European freight transportation market was valued at approximately 325 billion euro in 2020 and is expected to grow at a compounded annual growth rate of 4,3 % (2020-2025 CAGR) reaching 417 billion euro by 2025[1]. Driven by the overall dependency on the freight transportation market, vehicle body manufacturing is assumed to grow at a similar pace until 2025.

Freight market size in Europe 2020-2025 – in B€

Despite the negative effects of the COVID-19 pandemic, the European freight market is forecasted to reach 391 billion euro by the end of 2022[2]. International transportation across borders has seen stronger growth than within countries, mainly due to retail and e-commerce driven demand which has stimulated more import and export of consumer goods[3]. E-commerce sales data suggests that the pandemic has opened online retail channel to new demographics, and this will likely provide an uplift in growth over the medium-term.

The war on Ukraine has introduced new risk factors, including limited fuel supplies, and increasing fuel prices[4], which can have a negative impact on near-term growth rates.

The manufacturing of bodies industry in Europe is expected to reach 38,8 B€ in 2025

The industry for manufacturing of bodies for motor vehicles is comprised of five major categories: mainly manufacturing of bodies, cabins, trailers & semi-trailers, but also tankers and caravans.

Globally, the Asian Pacific was the largest region in the motor vehicle body market in 2021, followed by the Western European region. The increase in production of light commercial vehicles, buses, heavy trucks, and passenger cars have contributed to the increased demand for motor vehicle body manufacturing[5].

The European industry revenue of manufacturing of bodies, trailers and semi-trailers was valued at 31 billion euro in 2020[6]. Applying a same expected annual growth rate as freight transport (4,3%) the European industry revenue for manufacturing of bodies can be expected to reach approximately 38,8 billion euro by the end of 2025[7].

Manufacturing of bodies industry expected to grow by 7,4 B€ until 20258

The European industry revenue declined by 12 % from 2019 to 2020, due to COVID-19 related restrictions and disruptions. However, the market is set to recover as a consequence of increased production for motor vehicles, light commercial vehicles, and heavy trucks, which indirectly increases the demand for manufacturing of bodies[8].

Despite the pandemic, the Nordic market has grown historically at a compounded annual growth rate of 7,0 % since 2016 and was valued at 2,7 billion euro in 2020[9]. Norway was a big driver for growth in the Nordics, being the only country where the overall market did not shrink in 2020[10]. Furthermore, the Finnish market is set to grow as well in the mid- to long-term, growing from 630 million euro in 2020, to 771 million euro in 2025[11].

In conclusion, in the medium- to long-term, the increased demand for cross-border transportation of consumer goods will have a positive impact on the production of commercial vehicles, and indirectly creating additional demand for manufacturing of bodies.

Selected examples of M&A activity

Though our analysis on past M&A activity, we have noticed that the market is consolidating toward a more comprehensive product offering. Large players are looking for specialists in demanding niche markets in order to establish a local presence through geographical expansion. It seems, that buyers are looking to develop into full-service providers through vertical integration enhancing cross-selling capabilities, customer retention and expansion into new areas. The third type of buyer category are consolidators and private equity firms that are consolidating the market, trying to buy and build mid-sized attractive targets into large entities before selling to larger industrial operators or PE firms.

Selected examples of M&A activity in the industry[12]:

Transaction data of truck body manufacturing industry

A sample of the acquisitions in the truck body manufacturing industry covers 53 transactions with 12 public multiples. The median EV/Revenue -multiple was 0,6X with median revenue of €21,3 million. The median EV/EBITDA multiple was 7,8X with median EBITDA-% of 6,5% and the median EV/EBIT was 14,9X with median EBIT-% of 4,6%. The large variation between the EV/EBITDA and the EV/EBIT multiple generally indicates a large capital expenditure base in the sample.

The sample containes one major outlier with 6,5X EV/Revenue. Without the outlier, the median EV/Revenue was 0,57X and the average was 0,52X. Generally the variation between the three multiples is quite large. The variation in profit based multiples is most often to do with the acquired company’s transaction year profitability. Generally speaking, low profitability companies receive a high profit based multiple and low revenue based multiple, and vice versa.

Pontus Kaisti

Analyst

[1] Transport Intelligence & Statista (2022)

[2] COVID-19 Recovery Tracker, Transport Intelligence (2022)

[3] European Road Freight Transportation market forecasts for 2021 and 2025, TI-insights (2022)

[4] Impact of Russia’s invasion on Ukraine on the markets: EU response, European Council (2022)

[5] Motor Vehicle Body Global Market Report (2022)

[6] Eurostat (2022)

[7] Nordic Growth Estimates (2022)

[8] Motor Vehicle Body Global Market report (2022)

[9] Eurostat (2022)

[10] European Road Freight Transport Market Forecast for 2021 and 2025, Transport Intelligence (2021)

[11] Eurostat (2022)

[12] Nordic Growth analysis