The invoicing market is experiencing a time of exceptional disruption. This development was kickstarted by private companies as new technology has made much of the older processes obsolete. Why the disruption is happening at full force only now, is that governments have stepped in to accelerate the move toward fully electronic and highly automated invoicing, the EU being the main force behind this process.

According to Billentis’ (2019) report, the global invoice volume stands at 550 billion invoices annually, which is set to quadruple by 2035. Only 55 billion is comprised of paperless invoices, of which only a minority can be classified as true e-invoices. The size, in monetary terms, of the e-invoice market in 2019 is estimated at €4,3B and set to reach €18 B by 2025[1].

European B2B and B2G invoice markets are experiencing dramatic change

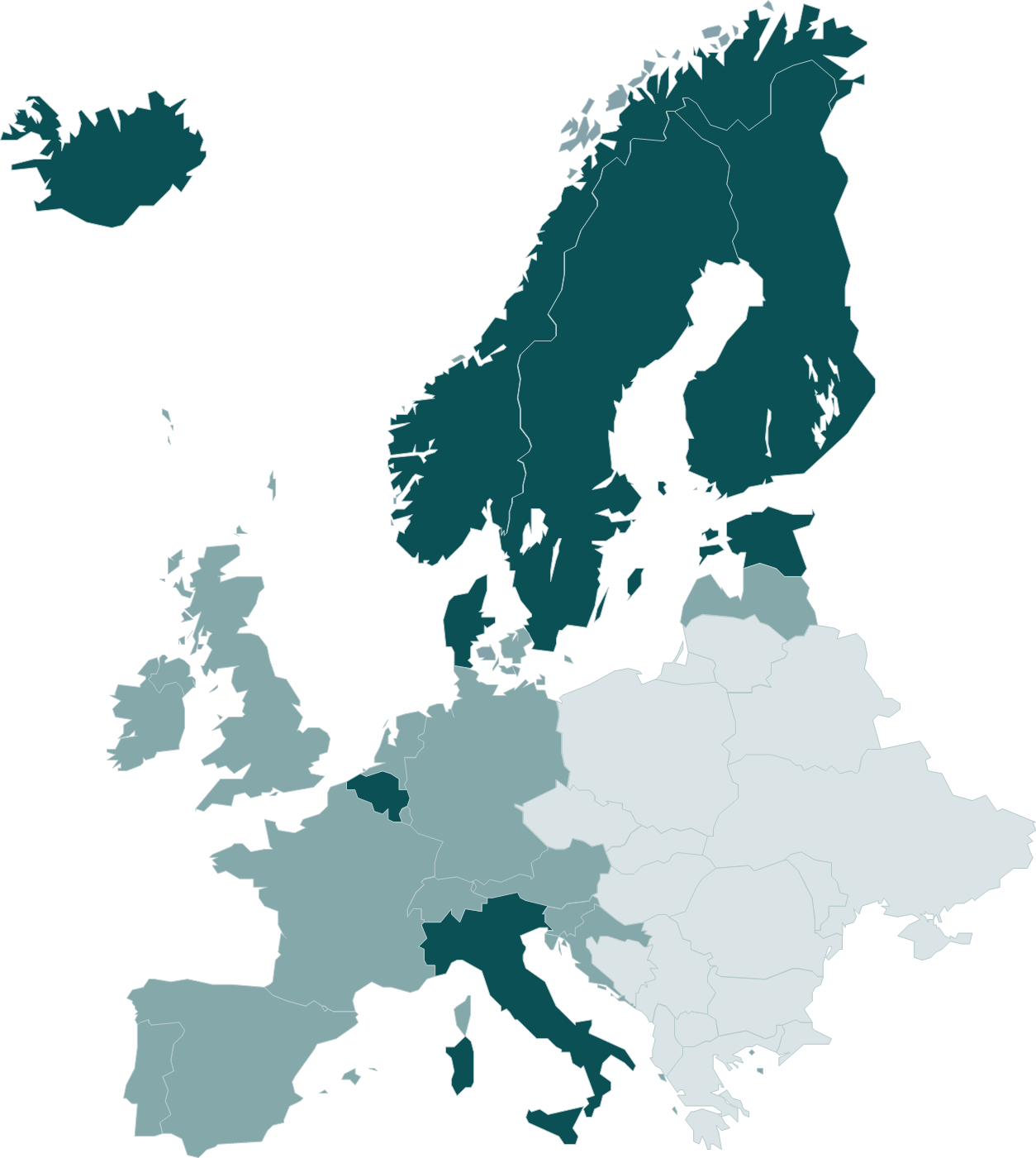

The e-invoicing market in Europe has traditionally been extremely fragmented and in different stages of development. The Nordic countries have been forerunners when it comes to all kinds of e-invoices; B2C, B2B and B2G. Even there, though, practices have varied by quite a lot. Sweden has a very well developed B2C e-invoice market, whereas Finland is clearly ahead in B2B e-invoice adoption.

Electronic invoices % in B2B, B2G and G2B:

Other countries with well developed, but quite distinct e-invoice practices compared to the aforementioned, are Italy and Belgium.

The market is about to face tumultuous times as the new EU directive (2014/55/EU) mandates that all governmental entities can require business clients to send, receive and process electronic invoices that meet the new standard. In Finland the mandate has been taken one step further allowing any company to demand only e-invoices from public entities.

In addition to public entities, this puts pressure on B2B transactions as well, as many companies invest in e-invoice capabilities and soon start to demand e-invoices from all their suppliers.

The directive is already in force and is expected to be the main driver of consolidating practices in the EU area as well as the number one driver of e-invoice growth. Companies from countries that have been ahead of the curve are expected to gain from the development.

The European e-invoice market value is expected to grow, despite the disruption, by single digit percentages. This is both due to very high adoption in some countries and, more importantly, due to price erosion expected to occur once the competition heightens and more advanced technologies are being adopted in laggard countries.[2]

Invoice like documents expand the market size by 5-15X in terms of volume

When trying to assess the e-invoice market as a whole, not only is the direct e-invoice market important, but also what has been termed invoice-like documents, which include all sorts of electronic receipts and transaction documents.

Including these makes the market a bit harder to quantify, as there isn’t a clear boundary, but different estimates put the number at 5-15 times larger than e-invoices alone. Some examples of invoice-like documents include:

- Invoice data for: tax authorities for validation, audit purposes, e-reporting or VAT statements

- Digital versions of traditional ‘fiscal printers producing payment receipts’.

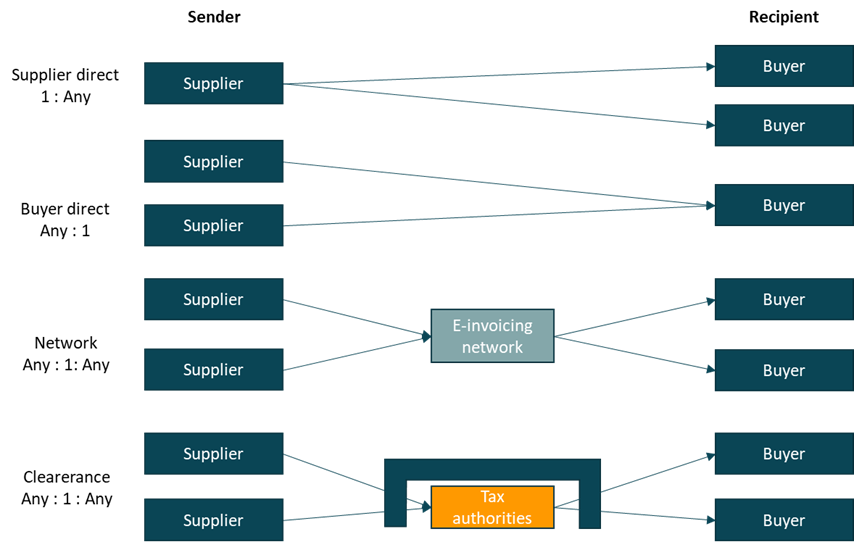

Main operating models:

There are 6 different business models for e-invoicing, some being hybrids between the above-mentioned operating models:

- Supplier direct model (in-house)

- Buyer direct model (in house)

- Outsourced direct model: SaaS and PaaS

- Network model, third party operator service

- Hybrid cloud models

- Clearance model

The supplier direct model is one where the supplier directly implements their own billing systems within their environments to distribute the invoice via preferred channel by the customer. The model is most common among high invoice-volume businesses like telecom, utility, card and online shopping portals. The model is also popular among small and micro businesses where bills are sent through email as .pdf attachments.

In the Buyer direct model the buyer implements his own invoice management solution for receiving supplier invoices electronically. This usually happens through keying in the invoice data in a web template, via webEDI (Electronic data management). This model is mainly used by large organizations with limited suppliers

The Direct model as a service is a model where both the issuer and receiver have just one interface, run by a specific service provider. These are nowadays mainly run by third party operators and for large organizations. The customers pay an integration fee as well as either a volume or time-based fee.

In the Network Model, both the issuer and recipient have just one interface they work with to the network operator. In this so called four-corner model, the operator manages the invoice transfer, data authenticity and data integrity. The format is also translated to the desired form. In addition, many network model operators offer additional services such as tax-compliant long-term archiving.

This model has been gaining market share steadily for the past 20-years and we expect it to become dominant in most countries in the medium term.

On top of the aforementioned traditional ways to operate, the recent developments have led to operating models such as Multi-cloud and hybrid cloud.

Nordic market size

In this section, we refer to Nordics as also including the Baltics, as these countries share much of the competitors and ways to operate within e-invoices and other e-transaction documents.

When assessing the total market potential for B2G2B e-transactions for the medium term, we take the forerunner market, Finland, as the starting point and extrapolate this information to the other Nordic markets, as these are expected to develop in a similar manner.

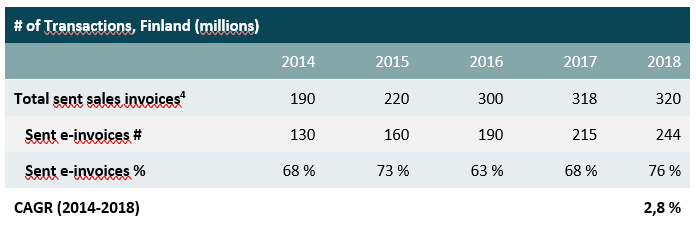

Electronic invoices sent by banks and operators in Finland[3]

Extrapolating this statistic to the other Nordic markets, we assume a similar number of transactions per inhabitant. The current price per transaction varies from 10c to 1,4€, depending on provider and transaction volume[5]. The following graph sums up the results.

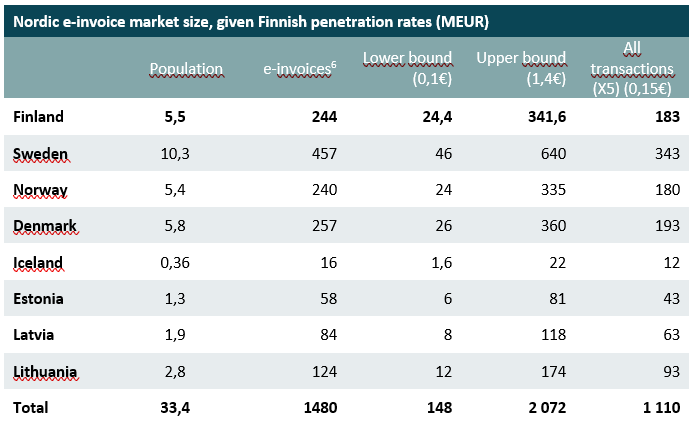

Nordic addressable e-invoicing market estimate given Finnish adoption rate

The total Nordic (including the Baltics) market for B2B2G e-invoices, with Finnish adoption rates gives a total volume of 1,48 B transactions. The cheapest solutions on the market charge 0,1€/e-invoice, giving a lower bound of the Nordic market potential at 148 M€. Using Bruno Koch’s lower bound estimate of a minimum of 5 times the volume for all electronic transactions and using a conservative 0,15€/transactions price estimate gives a total market size of 1,11 B€.

The current e-invoice penetration in the rest of the Nordics is lower than in Finland, but precise statistics do not exist on B2B invoicing. The only available source sets the penetration rate at a rough >40 %[7]. This number should be regarded as a lower bound, although the penetration rate according to Nordic Growth research is well above this level. A 40 % penetration would make the current market size for the Nordics excluding Finland 648 M transactions or 64 – 907M€, depending on the average cost per transaction.

Saul Schubak

Managing Director

[1] Billentis (2019)

[2] Billentis (2019: 45)

[3] Nordic Growth, Suomen pankki (9.7.2020): https://www.suomenpankki.fi/fi/Tilastot/maksuliiketilastot/taulukot/

[4] Includes both e-invoices and invoices sent to email or to be printed

[5] Industry expert estimate, Nordic Growth research

[6] Given same number of invoices per person as Finland

[7] Billentis, (2019)