The Finnish electrical installation industry is a highly fragmented and competitive market with both local and international companies. Renovation debt in the aging Finnish building stock and new energy efficiency requirements keep a steady demand, while building automation, IoT and electrical vehicle (EV) charging stations create new growth areas for market participants.

Overview of the Finnish electrical installation market

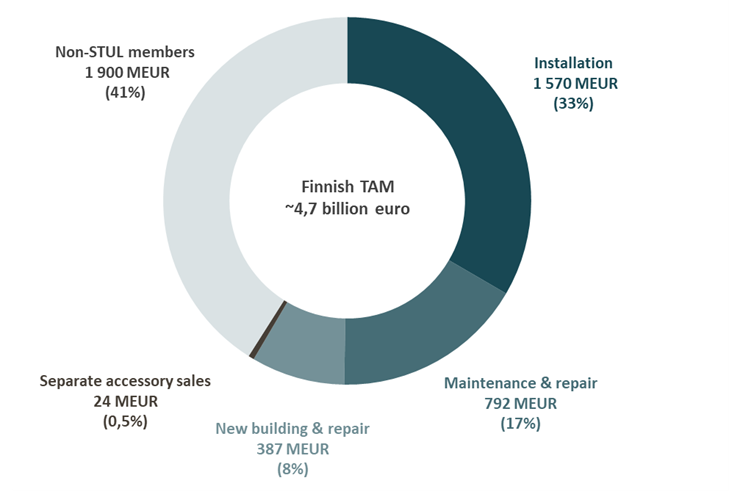

Electrical installation industry turnover in Finland amounted to approximately 4,7 billion euros. Total industry revenue for electrical installation in Finland grew with a compounded annual growth rate (CAGR) of 4,95% from 2017 to 2021. Revenue within the electrical installation market in Finland grew by 8,08% from 2020-2021.[1] The longer-term compounded annual growth rate (CAGR) for 2020-2025 is estimated to be around 3,4%.[2]

Total addressable market for electrical installation in 20211, [3]

Within the market, approximately 2,8-billion-euro (59%) of the total industry revenue is comprised of companies that are members of the Electrical Contractors’ Association in Finland (STUL). The association divides the industry in four categories: installation, maintenance & repair, new building & repair and separate accessory sales.[4] Electrical installation work comprised more than half (56,6%) of the turnover of the member companies of STUL, while the share maintenance and repair comprised 28,6%. According to Talotekniikkaliitto, approximately 28% of the electrical engineering industry revenue is comprised of working hours and over 50% comes from material acquisition.[5]

In Finland, the electrical contracting industry is made up of many small, local companies and a smaller number of larger firms that operate throughout the country. These larger companies often provide a wide range of services, including electrification as well as heating, ventilation, and air conditioning (HVAC) and other specialized construction and building technology services. Nearly two thirds of the number of STUL’s member companies generated annual turnover below EUR 0,5 million (5,6 % share of total turnover) in 2019. Enterprises with more than EUR 10 million annual turnover, 37 in total (2,4% of the number of STUL’s members), generated 55,3% of the total turnover (EUR 1,5 billion).[6] These figures have not seen major changes since 2019.

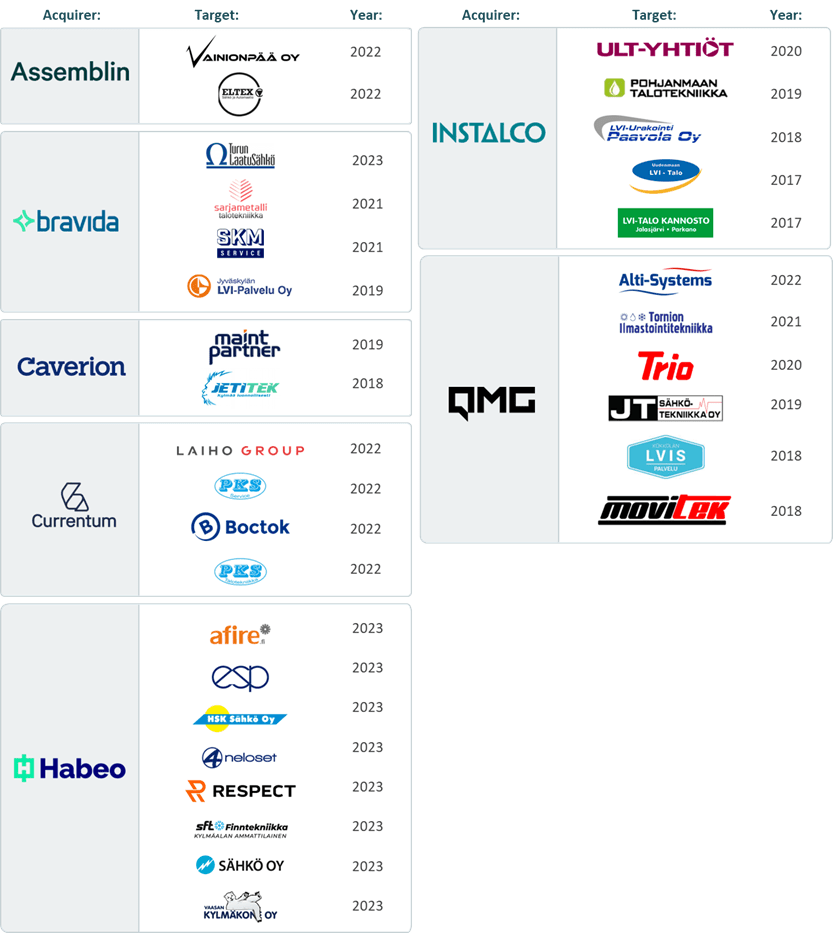

Recently, the industry has seen some horizontal consolidation, with large companies expanding their services to offer a wider range of building technology solutions. This is driven by a growing preference among construction project owners and contractors for turnkey solutions and smaller number of sub-contractors. Instead of narrow focus on electricity, the companies can offer total building technology contracting including HVAC services. The focus on wider service offering reduces market space for the smaller operators, driving further industry consolidation. To remain competitive, smaller operators may need to form partnerships and networks to offer more comprehensive service packages.

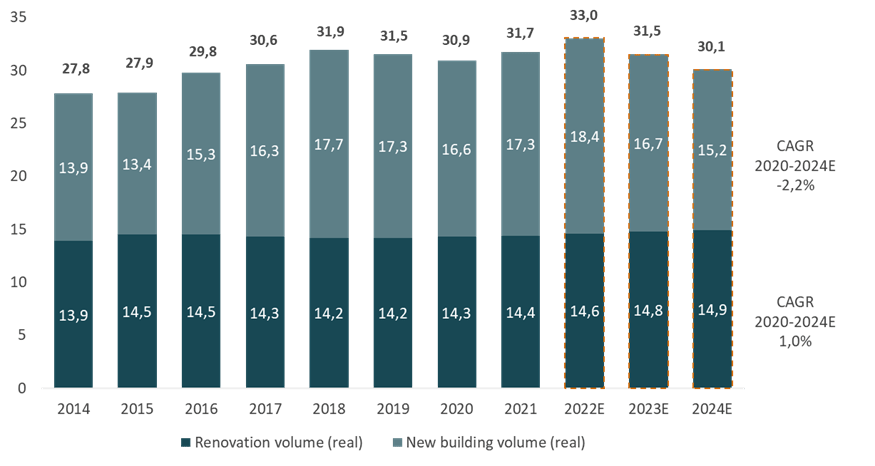

Renovation and specialized activities support the Finnish construction market, as new building declines

According to Euroconstruct, the value of building renovation amounted to approximately EUR 14,4 billion in 2021, representing 45% of total building volume in Finland.[7] Historically, after a strong growth period 2016-2018 (CAGR 9%) renovation output by volume has seen steady growth and it is expected to maintain a positive output increase of approximately 1% (CAGR) 2020-2024E, when new construction has decreased. Although the cubic volume of granted new construction permits increased in 2020-2021, during 2022 and especially Q4 of 2022, new building permits decreased by roughly one third from a year earlier, in total 8,4 million cubic meters. Additionally, the cubic volume of new building projects decreased by 24% from a year ago[8].

However, the aging Finnish building stock requires upgrades to meet modern standards for energy efficiency and sustainable solutions. Additionally, specialized activities (i.e., energy-efficient technology) are in high demand since both the public and the private sectors seek to reduce their energy consumption.

Development of new building and renovation construction market in Finland (2014-2024E)[9]

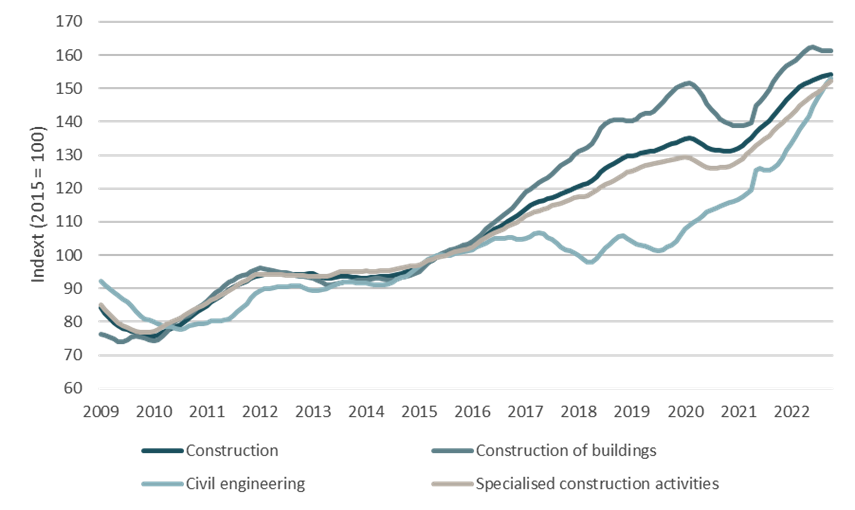

At the end of Q1 of 2020 the construction industry as a whole saw a downturn in turnover, with a decreasing trend that continued for approximately 6 months ending in Q4 of 2020. The effect of the Covid-19 pandemic is seen to be the main cause for the overall market contracting. However, the industry revenue has seen a clear upswing since the end of 2020, ending in 2022, when rising interest rates and uncertain economic situation turned the market down again. Renovation volume maintains relatively steady development over the whole ten-year period.

Trends in turnover of construction by industry[10]

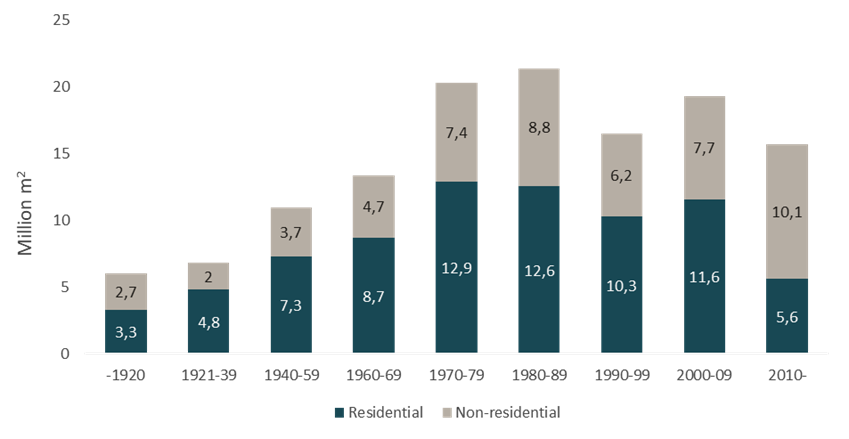

The current age distribution of the housing stock in southern Finland illustrates that a significant amount of the housing stock is close to 50 years old. Buildings that have been built between 1960-1999 comprise a notable share of the current building stock, which during the following 15 to 25 years will need renovations, providing stable demand for renovation contracting in the long-term. Based on VTT’s renovation need analysis, the total residential renovation demand for the period of ten years 2015-2025 is 9,4 billion euro annually.[11] The current aging apartment base and new energy efficiency requirements increase demand for HVAC and electrical contracting.

Finnish building stock by construction year[12]

Market is consolidating toward a more comprehensive service offering

The electrical installation and maintenance industry in Finland is fragmented, comprising many small regional operators and few large domestic and international players. Many of the larger companies offer a more comprehensive service portfolio, often including other specialized construction and building services technologies (HVAC) activities as well.

During the past 10 years, the number of HVAC companies decreased slightly (~150 companies), while the total industry revenue has increased. This indicates a maturing market, in which existing companies consolidate to achieve economies of scale. This trend is further supported by HVAC and electrical installation M&A activity in Finland, in which large organizations have opted to buy smaller, regional firms for a more comprehensive assortment of HVAC servicers that cover a wider geographical area.

The M&A activity below shows that there have been five active consolidators in the market for some time. During the past year, Currentum and Habeo have joined this group, indicating that there is still space for new operators in the field.

During 2023, Triton’s formation of Habeo Group, consisting of eight companies turned into one national operator. The newly formed group consists of: Afire Oy, ESP Group, HSK Sähkö Oy, Neloset Group, Respect Group, SFT Finntekniikka Oy, Sähkö Oy Turku & Helsinki, and Vaasan Kylmäkone Oy. Habeo Group employs approximately 600 technical building services professionals with a pro forma revenue of 120 million euro in 2021[13], which have become a big new player, especially in Finland.

Additionally, in 2022, Currentum acquired four Finnish companies. The companies included: Boctok Oy, Laiho Group Oy, PKS Talotekniikka Oy and PKS Service Oy. The combined annual revenue of the newly acquired companies was around 40 million euro and employed about 220 people[14].

In conclusion, the highly fragmented market with a trend towards add-on acquisitions is seen by the active M&A environment in recent years.

Selected examples of M&A activity in Finland (2018-2023)[15]

Pontus Kaisti

Analyst

[1] Statistics Finland: Enterprises by industry and turnover– TOL 4321 (2023)

[2] Eurostat & Statista (2023)

[3] The Electrical Contractors’ Association of Finland (STUL) – Liikevaihtokysely 2022 (2023)

[4] The Electrical Contractors’ Association of Finland (STUL) – Liikevaihtokysely 2022 (2023)

[5] Talotekniikkaliitto (LVI-TU) – LVIS-kokonaismarkkina 2022 (2023)

[6] The Electrical Contractors’ Association of Finland (STUL) – Liikevaihtokysely 2019 (2023)

[7] Consti Group Plc: Q3 2022 Investor Presentation – Euroconstruct, June 2022 (2023)

[8] Statistics Finland – Building & dwelling production publication 21.2.2023 (2023)

[9] Consti Group Plc: Q3 2022 Investor Presentation (2023)

[10] Statistics Finland: Index of turnover of construction (2023)

[11] VTT Technical Reasearch Center of Finland & Tampere University of Applied Sciences (TAMK): Long-term strategy for mobilising investment in the renovation of the national stock of residential and commervial buildings, both public and private

[12] Confederation of Finnish Construction Industries RT

[13] Habeo Group website: Habeo Group emerges as a new significant provider of technical building services, 16.2.2023

[14] Firmnav (2023)

[15] Nordic Growth analysis (2023)