The Finnish solar wholesale market shares typical wholesale characteristics, where economies of scale allow larger players to grow faster and achieve greater profitability compared to their smaller competitors. Out of the firms that existed five years ago, only a few remain, and we anticipate this trend of consolidation to continue.

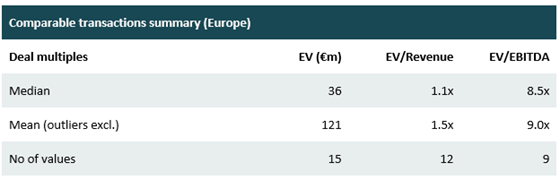

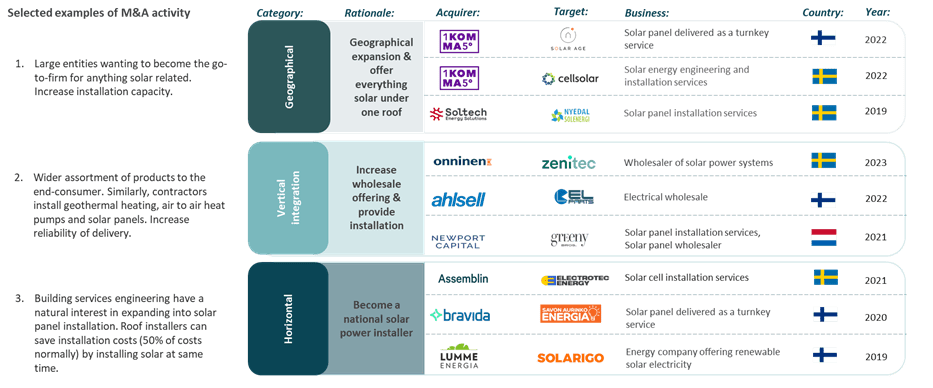

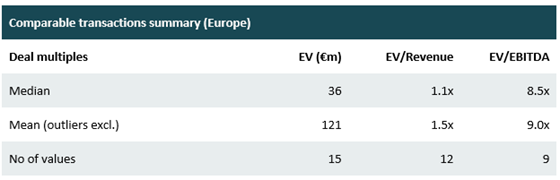

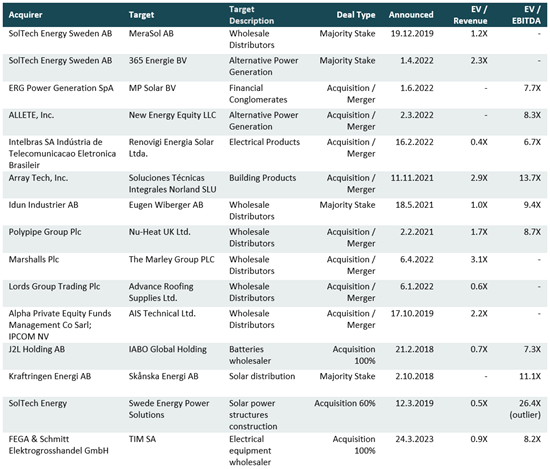

M&A activity has been prominent, with large entities acquiring solar panel installers, wholesalers, and related companies to be a top player in the few-winners-take-all market. The table below displays (average) deal multiples and M&A transactions where the target company primarily engages in solar panel wholesale in Europe.[1] The individual deals are available at the end of the report.

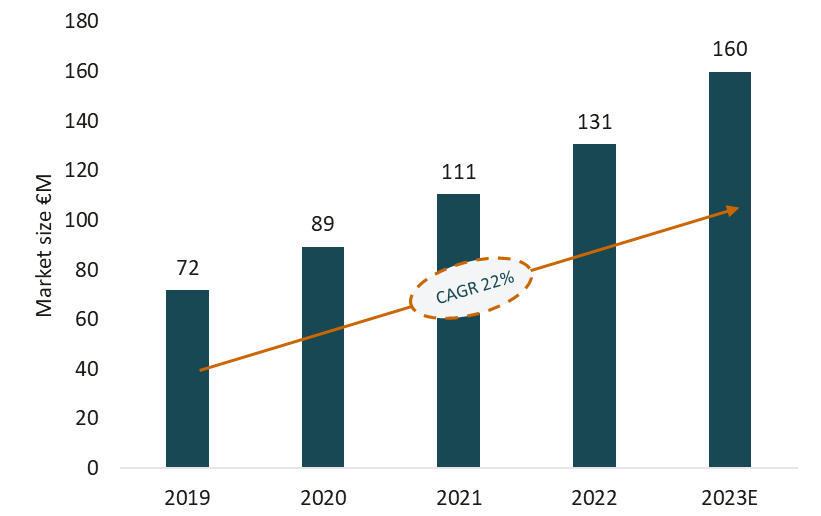

The solar panel market consists of two distinct segments: industrial-scale solar panel farms and micro-production, which refers to panels installed on the roofs of commercial and residential properties (units under 1 MW). This report focuses on the micro-production wholesale subsegment, expected to reach €160M in 2023, powered by 22% YoY growth. Key drivers include favorable government incentives, supportive EU policies aimed at doubling solar production by 2025, and recent high energy prices that have sparked a desire for energy self-sufficiency.

Market Size & Growth:

The retail cost of installed grid-connected solar panels totals €1.45/W[2]. In 2022 ~120 MW of new micro-production capacity was connected to the grid, resulting in an estimated retail market size of €174M. As end-users pay for the installation work, which comprises 25% of the total cost of setting up solar panels, the wholesale market size is ~€131M. Considering the market’s expected growth trajectory, the projected wholesale market size for 2023 is €160M.

According to the Ministry of Economic Affairs and Employment of Finland, the electricity produced by solar panels will grow from 0.1 TWh in 2020 to 1.1 TWh by 2030 and 6.0 TWh by 2050.[3] There is considerable room for growth, as putting it into perspective, in 2020, 0.3 % of the total Finnish electricity production (67 TWh) was solar power. While most solar power capacity comes from large industrial-scale farms, the micro-production solar panel capacity is nonetheless significant, reaching ~515MW in 2022 and having grown with a CAGR of 51% over the last 5 years.

The theoretical maximum electricity production capacity of residential solar panels is 3.5 GW[4]. Of this maximum, under 15% was installed in 2022, a figure highlighting the market’s potential for growth. The potential capacity number is derived from the area of total suitable residential rooftop area for Photo-Voltaic (PV) production and the assumption that 0.13kW solar PV would be installed per 1m² of suitable roof space. The realistic total number is smaller, due to commercial viability and the capacity of the electrical grid. To illustrate, in Germany, Italy and Greece, where nearly 10% of annual electricity production is solar, issues due to the weather-dependency and distributed nature of electricity production are prevalent. Finnish electricity producers and network companies face similar challenges.[5] Yet, given that solar power accounts for less than 1% of total electricity production in Finland, growth in the solar panel market is likely to continue relatively unobstructed medium term.

Figure 1: Finnish micro-production solar panel wholesale market showing sustained growth[6]

Market Drivers:

Government subsidies and mandates are driving the green energy transition as part of green values and a transition away from fossil fuels. Additionally, over the last few years the price of grid electricity has experienced high volatility with a major spike at the end of 2022, which has acted as major driver toward solar micro-production. While prices are expected to decrease from their 2022 highs, the energy price volatility will remain a factor for self-sufficiency.

Subsidies

In Finland, the green transition megatrend is supported by governmental incentives for greener energy procurement. The subsidy amounts can be split into three main categories.

- For Individuals: 40% household deduction for installation and other labor costs capped at €2.25k/person per year.[7] For example, a 5 kWp solar power plant costs €8.5k. You get a household deduction for the part of the installation, leaving around €7.5k to pay. In addition, individuals do not have to pay VAT (24%) for self-generated power.

- For Housing companies: an energy subsidy granted by The Housing Finance and Development Center (ARA), typically near 25% of the approved total costs, capped at €4,000 or €6,000, depending on the case.[8] In more detail, the scope of the energy subsidy includes more than 20 different energy efficiency improvement measures that can be subsidized. The condition of the support for the repair project is the improvement of the building’s efficiency (E-number) by a specified factor compared to the E-number at the time of construction. The equipment used to utilize solar energy, with the necessary cable and pipe runs, is among the supported measures.

- Companies, municipalities, and other communities: energy support from the Ministry of Labor and the Economy aims to promote the introduction of new energy technology and its introduction to the market. Based on a project-specific consideration, the Ministry can grant energy support to solar electricity projects of companies, municipalities, and other communities. As of May 1, 2019, the indicative support percentage of acceptable costs is 20 percent.

EU mandates

The EU is tightening energy efficiency requirements for new buildings: in the future, a solar power system may have to be connected to new buildings already during the construction phase. The planned requirement would apply to both private and public new houses with a usable area of more than 250 square meters. This requirement would enter into force by 2026. By the following year, roofs of old public buildings and commercial premises of more than 250 square meters would also be put into use. By 2029, the obligation would extend to all new residential buildings. In other words, the green transition is backed by long term policies that will help grow the solar panel market. In addition, the European Commission recently proposed revising the Directive to require each member state to renovate the least energy-efficient 15% of their building stock to be more energy-efficient.

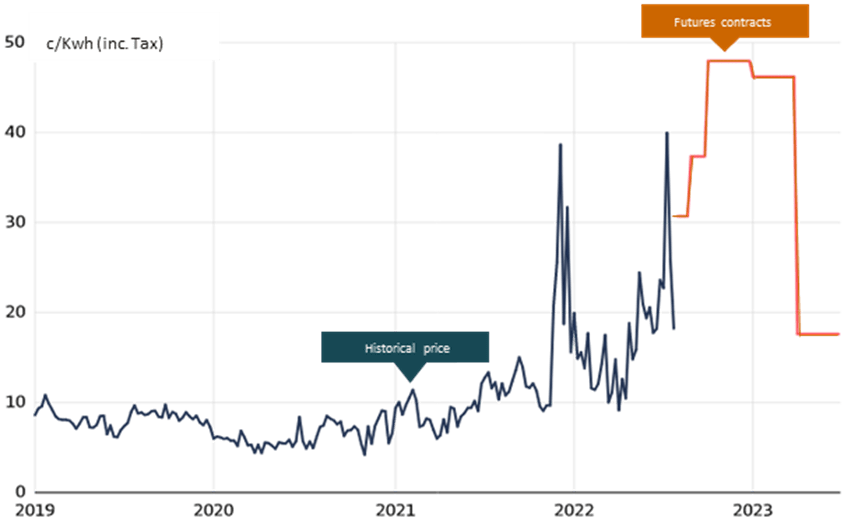

Energy Prices

Energy prices have played a key role in the increased desire to purchase solar panels. As show in the figure below, energy prices saw roughly a 300% price hike during 2022 and thus, the increased and more volatile energy prices provide additional incentives for homeowners to improve their houses’ energy efficiency. The rising electricity cost rose even prior to last year as the annual average spot price of electricity in the Nordics and Baltics was 1.09 kWh in 2020 and 6,23 kWh in 2021. During the first 7 months of 2022, the average spot price was 11.2 kWh, which was almost tenfold to 2020 and 80% higher than in 2021[9].

The figure below shows electricity price development as monthly averages. So far, the highest average prices have been seen in March during the first month of the Russian war of aggression. The price spike seen right after the war has since leveled off. Although longer term price developments are difficult to gauge, electricity futures contracts indicate price (shown in orange) decreases as shown in the graph. Even as energy prices decrease, the expected payback time of an investment in solar panels is expected to be much shorter than before due to steadily increasing efficiency.

Figure 2: Energy prices saw a rapid price hike in 2022, but are expected to decrease[10]

M&A Activity:

The M&A market in solar panels has been active over the last few years and reflects the direction of the competitive landscape. Lately, large entities have wanted to become the go-to-firm for anything solar related, including German 1Komma5° and Soltech purchasing Nordic solar panel installers increasing delivery of panels while expanding their geographical footprint.

Additionally wholesale firms such as Onninen, have opted to increase their product offering to include solar panels more widely by purchasing solar panel wholesalers, such as Zenitech. Their customers by-and-large consist of contractors who install green tech elements beyond solar panels, such as geothermal heating, air to air heat pumps.

In addition, building services engineering firms have a natural interest in expanding into solar panel installation. Roof installers can save installation costs (50 % of costs normally) by installing solar at same time. Thus, companies such as Bravida and Assemblin have been active in acquiring solar installers. Lastly, energy companies have shown interest in acquiring solar panel companies, as in the case of Lumme Energia.

Figure 3: Examples of M&A in the solar panel market

The below tables comprise information of (average) deal multiples and M&A transactions where the target company primarily engages in solar panel wholesale in Europe. Given the limited availability of published deal multiples, some chosen comparables operate in other wholesale segments i.e. electrical, construction equipment etc. In addition, some comparables provide solar panel installation services and a wider focus on the production of large-scale photovoltaic fields, which tend to have slightly higher deal multiples.

The competitive landscape has led to the situation where larger wholesalers have been able to benefit the most from the rapidly growing solar market through economies of scale in sales, purchases, financing, among other areas. The Finnish solar market is still young given its sub-1% share of solar to total energy production. By comparison, in Germany solar accounts for 12% of total energy production[11]. The nascent market provides more opportunities for companies to establish themselves as winners of tomorrow. In response to the market dynamics, M&A activity has been prominent, with large entities acquiring solar panel installers, wholesalers, and related companies to strengthen their market position and be a top player in the few-winners-take-all market, where companies with the largest scale advantages are expected to continue dominating.

Mikael Reijonen

Analyst

[1] NG analysis of deals from FactSet and Zephyr databases.

[2] International Energy Agency

[3] TEM: Sähkömarkkinat vuoteen 2050

[4] Niiranen M.: Microproduction of Solar Electricity in Finland: Statistical Analysis

[5] https://energia.fi/files/786/Roadmap_2025_loppuraportti.pdf

[6] Energiavirasto: Aurinkosähkön kapasiteetti kasvoi Suomessa yli 100 megawattia vuonna 2021: https://energiavirasto.fi/-/aurinkosahkon-kapasiteetti-kasvoi-suomessa-yli-100-megawattia-vuonna-2021

[7]“Aurinkosähkötuotannon Taloudellinen Tukeminen.” Motiva, https://www.motiva.fi/ratkaisut/uusiutuva_energia/aurinkosahko/jarjestelman_valinta/aurinkosahkotuotannon_taloudellinen_tukeminen.

[8] “Ara – Aurinkopaneeleiden Hankintaan Voi Saada Aran Energiaa.” Ara > https://www.ara.fi/fi-FI/Ajankohtaista/Uutiset_ja_tiedotteet/Uutiset_ja_tiedotteet_2022/Aurinkopaneeleiden_hankintaan_voi_saada_(63643).

[9] Valtiovarainministeriö: Arvioita mahdollisista toimista sähkön korkeaan hintaan liittyen

[10] “Tässä Markkinoiden Varmin Ennuste: Sähkön Hinta Kolminkertaistuu Loppuvuonna, Mutta Keväällä Nähdään Hintaromahdus.” Yle Uutiset, https://yle.fi/a/3-12558752.

[11] “German solar power capacity in 2022 sees fast growth, still well below target”, Clean Energy Wire, https://www.cleanenergywire.org/news/german-solar-power-capacity-2022-sees-fast-growth-still-well-below-target#:~:text=By%20the%20end%20of%202022,power%20production%20in%20the%20country.