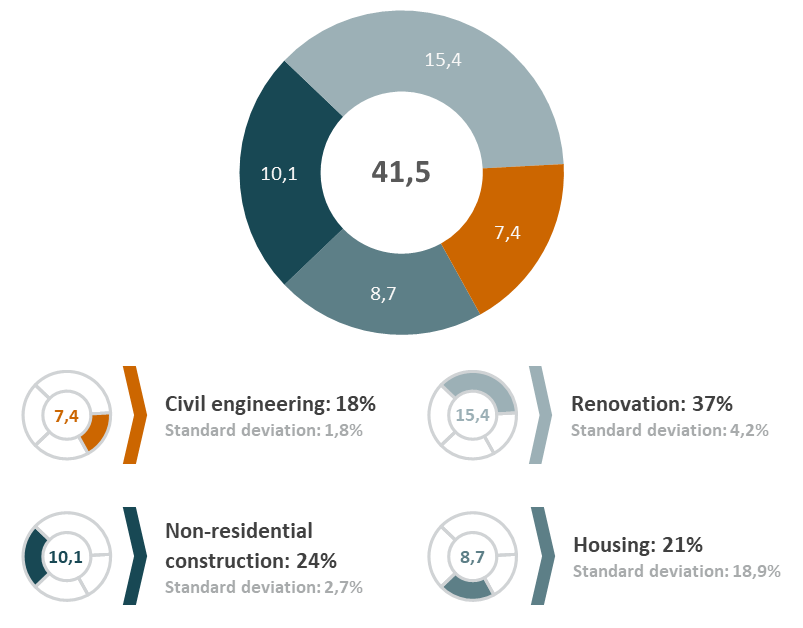

In the Finnish infrastructure market, valued at 41,5 billion euro, the civil engineering sector is a significant component, constituting 17,8% and showing a consistent growth trend. The sector is projected to reach a market size of 7,6 billion euro by 2027.

Government initiatives and a focus on sustainable development are key drivers of growth. The competitive landscape is characterized by a diverse range of players, from local firms to multinational corporations, operating in a market with high barriers to entry but a persistent demand for innovation and efficient practices.

The Finnish infrastructure market

In the Finnish infrastructure landscape, the civil engineering segment constitutes a notable subcategory. This sector, distinct from housing, non-residential construction, and renovation, includes critical activities such as earthworks, road, water, pipeline, railway, port, and environmental construction, alongside their respective maintenance operations. For the purposes of market analysis, this civil engineering component will be the focal point in assessing Finland’s total addressable market.

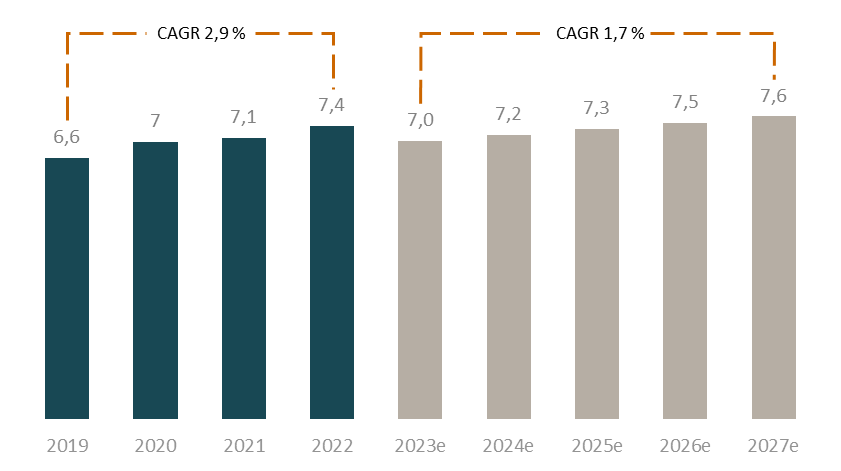

Market size and growth

Finland’s infrastructure sector was valued at 41,5 billion euro in 2022, with the civil engineering segment accounting for 17,8% of this figure. The civil engineering sector has observed an upturn from an estimated 6,6 billion euro in 2019 to around 7,4 billion euro in 2022, yielding a Compound Annual Growth Rate (CAGR) of 2,9%. The projection indicates a subtle shift in momentum following an anticipated 5% decline from 2022 to 2023, with an anticipated CAGR of 1,7% from 2023 to 2027. This forecast suggests a gradual increase in the market size, expected to touch approximately 7,6 billion euro by the year 2027.[1]

The Finnish civil engineering market size in billion euro

Market demand

Finland’s market has shown consistent expansion over the last two decades, with expectations that large-scale infrastructure initiatives will continue to propel economic advancement. Enhanced financial prosperity, demographic expansion, and the urbanization process are amplifying the need for substantial investment in infrastructure. The anticipated urban expansion in Finland’s major cities is projected to surge by 14% in the span from 2021 to 2040, further reinforcing the imperative for infrastructural development to keep pace with the evolving urban landscape[2].

The civil engineering segment in Finland is currently the most stable within the construction market, particularly highlighted in the post-pandemic period from 2021 to 2024. It’s marked by a low standard deviation of 1,8%, distinguishing it as the least volatile segment. This contrasts with the housing sector, which exhibited substantial fluctuation over the same period, and yielded a higher standard deviation of 18,9%[3]. The requirement for enhanced water infrastructure is highlighted by an extensive repair backlog, quantified in recent analyses as necessitating an annual investment of approximately 777 million euros to address until the year 2040.[4] This need reflects a broader trend of growth within the civil engineering industry.

The construction market segmentation and stability in billion euro

The government’s commitment, as outlined in the National Transport System Plan for 2021-2032, signals robust support for the industry. A significant portion of the 6,1-billion-euro budget is allocated for the development of new infrastructure, translating to an investment of 3,4 billion euros or 55,7% of the total budget.[5] This investment is aimed for the modernization and expansion of the sector, accommodating the rising demands of a growing population and the imperatives of urban development.

Furthermore, the focus on sustainability is set to influence demand patterns. As environmental regulations tighten and the shift towards lower-emission machinery accelerates, the industry must adapt, potentially catalyzing further investment in innovative technologies. This shift represents both a challenge and an opportunity for growth, fostering a market environment that values resilience, adaptability, and foresight in the face of evolving regulatory landscapes and the pressing necessity of infrastructure renewal.

Competition

The competitive landscape for civil engineering in Finland is diverse, encompassing both domestic and international entities. This landscape can be segmented into four distinct categories. Initially, there are smaller companies, primarily acting as subcontractors for larger projects managed by mid-sized or large contractors. Next, the mid-sized players often serve as primary contractors, specializing in specific areas within civil engineering such as water supply or earthworks.

Larger companies offer a comprehensive range of services, from road and railway construction to intricate foundation work. Additionally, multinational corporations provide infrastructure services alongside other construction ventures, such as residential and commercial development.

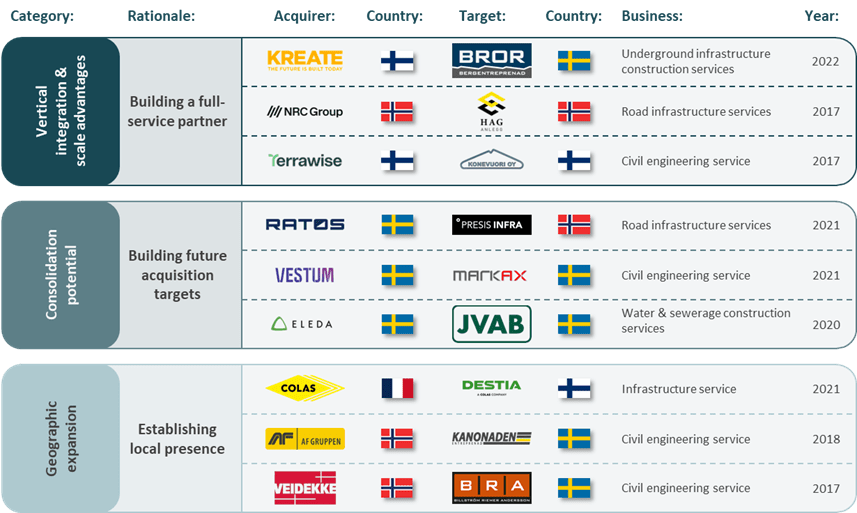

Operational strategies among these players vary, with some focusing on service expansion, mergers and acquisitions, collaborations, research and development, and geographic growth. Larger companies have been increasing their market share through acquisitions and regional expansions.

Selected M&A transactions

Given the capital-intensive nature of the industry, there is a relatively low threat of new entrants. Established companies already possess the necessary technology and machinery, which require significant upfront investment. However, opportunities do exist for new entrants with innovative solutions.

The Finnish market is notably competitive, especially for companies vying to become the main contractor on projects. Specific areas like high-voltage electrical work, which require specialized certifications, demonstrate heightened competition. Yet, in more specialized fields such as demanding water services, competition is somewhat less intense. Expertise, extensive references, and specialized equipment are crucial, creating barriers to market entry.

Casimir Björkstén

Analyst

[1] Rakennusteollisuus RT (2022)

[2] Finland Construction and Infrastructure Market: OG Analysis (2019)

[3] Rakennusteollisuus RT (2022) and Nordic Growth analysis, Standard Deviation calculated from 2021-2024

[4] Suomen Vesilaitosyhdistys (2020)

[5] GlobalData (2023)