The precious metals manufacturing industry in the Nordics, valued at €1 billion, is a mature and highly competitive market that includes companies that produce jewelry, watches, and other precious metal items. The market is projected to experience a 1.4% growth rate (CAGR) between 2023 and 2026, slightly slower than the 2.2% global industry rate[1].

Consolidation is expected to continue as larger players capitalize on economies of scale and scope, pushing out smaller artisanal goldsmiths. Namely, larger operators will continue to disproportionately benefit from advances in technology, such as CAD and 3D printing, and specialization in either serial or batch manufacturing, which require significant investments.

The market is divided into three key segments: jewelry, watches, and silver product manufacturing, with a small segment of miscellaneous specialty products. By examining the Nordic market size through the retail segment, the combined jewelry and watches segment was valued at €1.92 billion in 2022 and is expected to grow at 1.4% CAGR (2023-2026).[2] The smaller silverware segment was valued at €70 million in 2022 and is expected to grow at a modest 1.0% CAGR (2023-2026).[3] Given the retail industry’s average 50% gross margin, the manufacturing of Nordic precious metals is roughly a €1 billion market growing at 1.4%.

Despite the challenges faced by the industry, such as declining consumer demand from reduced levels of disposable income and changing consumer preferences for other types of luxury goods, there are still opportunities for growth. The rise of e-commerce has made it easier for consumers to purchase jewelry and other luxury items from online retailers. Additionally, consumer demand for personalized jewelry and ethically and locally made products is driving growth. Furthermore, manufacturers see potential for exporting to developing countries with growing middle-class populations.

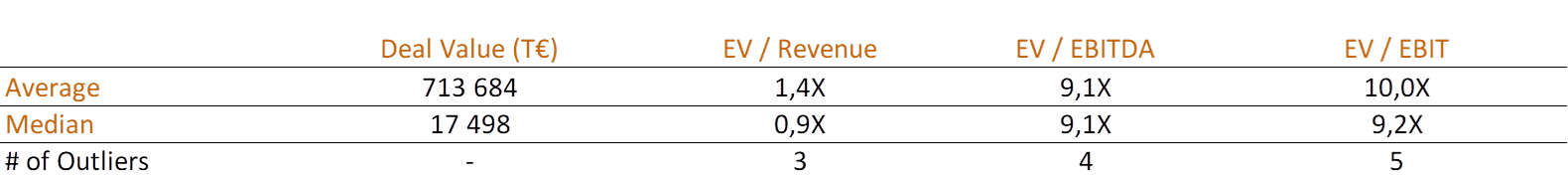

When considering the M&A scene in the precious metals manufacturing industry, a broad global perspective allows for enough deal volume for analysis. In the past five years, there have been an average of roughly 20 deals per year, totaling 104 industry-relevant deals. Of these deals, 22 have publicly known multiples, shown below[4]:

The multiples are generally relatively constant across deal sizes, and a curated list of five deals is provided. However, to showcase a true outlier, the highly publicized acquisition of Tiffany & Co. is provided for reference.

Mikael Reijonen

Analyst

[1] Combined jewelry and watches data for the European market:

Statista. https://www.statista.com/outlook/cmo/accessories/watches-jewelry/europe

[2] Combined jewelry and watches data for Nordic markets:

Statista. https://www.statista.com/outlook/cmo/accessories/watches-jewelry/nordics

[3] Combined silverware country-specific data for Nordics market:

Statista. https://www.statista.com/forecasts/897962/manufacture-of-cutlery-tools-and-general-hardware-revenue-in-finland

[4] NG analysis of deals from the Zephyr -database