The mining equipment market consists of products, solutions, and plants to serve the needs of exploration and mining companies. There are over 35 000 mines in the world operated by approximately 25 000 mining companies that provide the backbone for demand. [1][2] The market is at an inflexion point as the mining industry is digitalizing with the advent of smart mining solutions.

The importance of the mining industry is becoming more prevalent as nations and supranational entities have decided to depart on the journey to make their economies climate neutral. The objectives vary by country and jurisdiction, but all of them have one factor in common: an irreplaceable and accelerating dependency on metals and minerals.

Below we discuss the factors driving capital expenditure in the mining sector and its impact on the demand for mining equipment and smart mining solutions as well as the trends underpinning future market development.

Mining Equipment Market size

The global mining equipment market in 2022 is estimated at $US 135 billion and is expected to grow to $US 211 billion in 2031 at a compound annual growth rate of +5.1%.[3] The demand for mining equipment is dependent on the capital expenditure (“capex”) of mining companies.

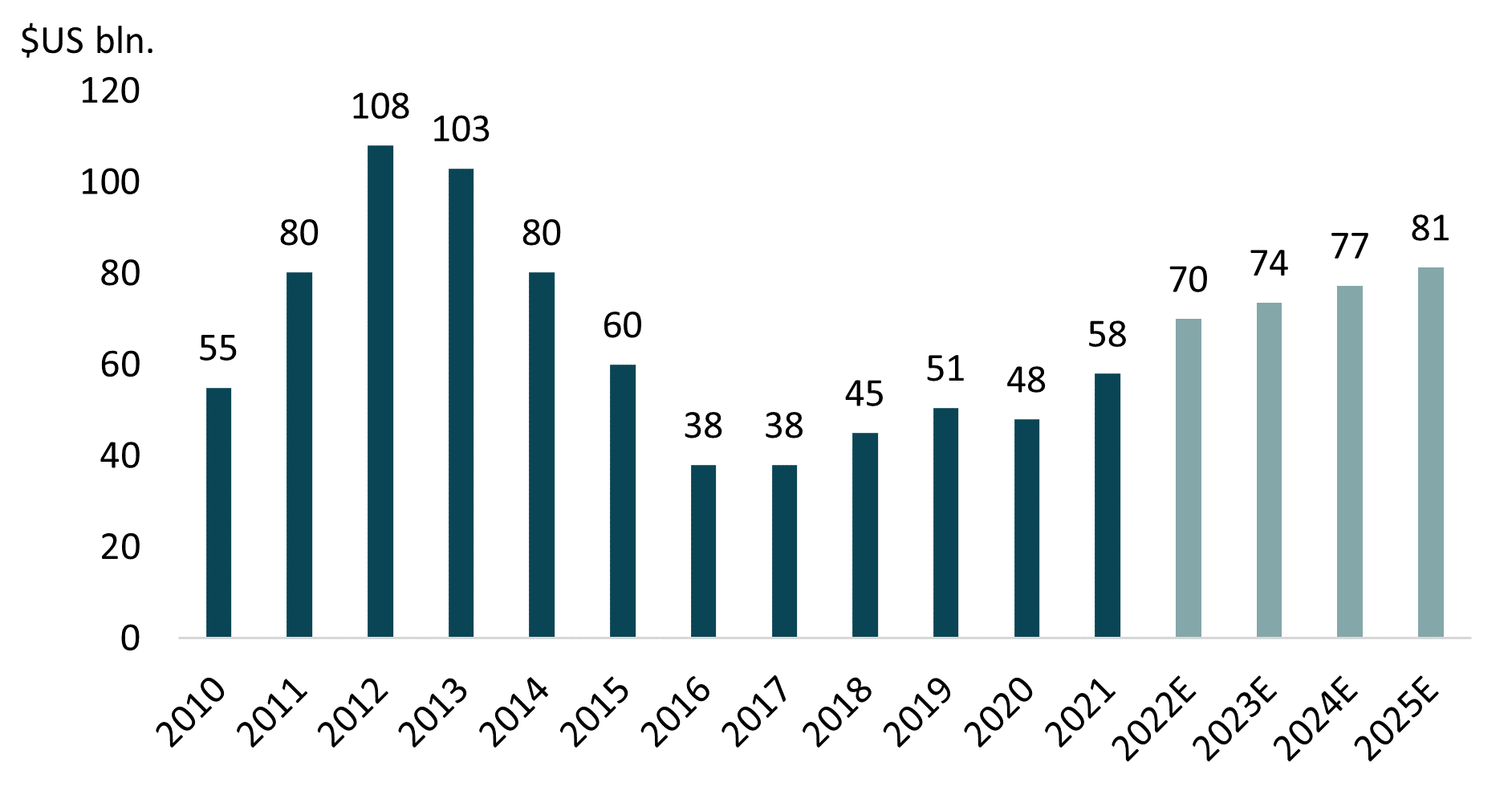

The chart below shows the fluctuations in CAPEX of the top 20 miners, which equate to nearly 50% of total mining capex in 2022, providing a proxy for the market’s behavior.

Capital Expenditure of 20 leading mining companies in $US billions 2010-2025E[4]

Below we briefly discuss the impact that metal prices and quality of available mining projects have on capital expenditure.

CAPEX Driver: Metal prices

Mining operations are sensitive to metal prices, which determine whether operations are profitable or not. Metal prices have a direct impact on the value of mines’ concentrate sales. Hence, mines have a cut-off grade for the ore mined. When prices fall and the mined ore is not of sufficient quality to maintain profitability, operations are halted.

The sensitivity to prices is best reflected in the reduction of development capex as a share of total spending. For example, 2012 was a peak year for mining capex and during this time development expenditure captured a share of more than 60%[5]. When base metal prices bottomed out in 2016 development capex was reduced to less than 30% of spending.

Historically, sustaining capex is less sensitive to price fluctuations as operating mines are less likely to stop investing into operations due to short-term price fluctuations.

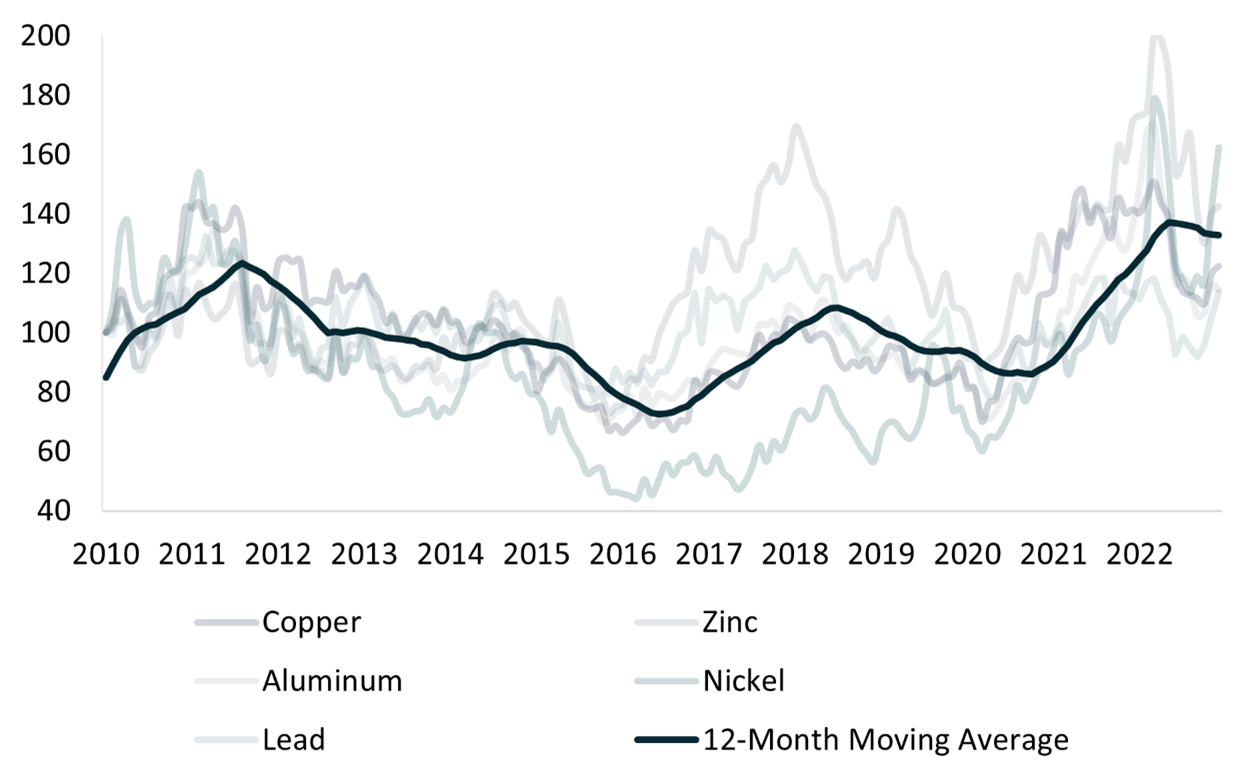

LME base metals’ price development from 2010 to 2022 (Indexed to 2010)[6]

The chart above shows the peaks and bottoms of base metal prices, which closely coincide with the capital expenditure highs and lows of the largest 20 mining companies. Capex numbers follow prices but provide explanatory power only in the short-term. Thus, the recent price rises are likely to only provide predictive power on capex development for the next one or two years.

CAPEX Driver: Quality of available projects

Mining companies’ willingness to spend is dependent on the quality of available projects. Key factor in determining a mine’s quality is its ore grade, which indicates the concentration of desired material per unit of ore. Ore grade has a direct impact on production costs as lower grades require exponentially more energy per extracted unit of desired material[7] and a higher volume of mining. All mines face the reality of falling ore grades over their life cycles.

For example, the world’s largest copper mine Escondida, in Chile, produces around 4-5% of global copper supply. When the mine began production, it contained ore grades of 2.5-3.0%, which have since then declined to around 0.5%[8]. Producing the same quantity of copper today requires 5-6 times the volume of mining and processing than when production began the 1980s. The issue of decreasing ore grades is expected to persist over time as studies have shown that mined ore grades are decreasing at 1% per year.

Falling ore grades increase operating expenditure in mines and make them less valuable investment opportunities and less likely targets for capital expenditure. Mining companies are likely to increase capital expenditure if exploration activities produce high grade deposits that make economic sense to exploit.

Smart Mining Market

Market Size

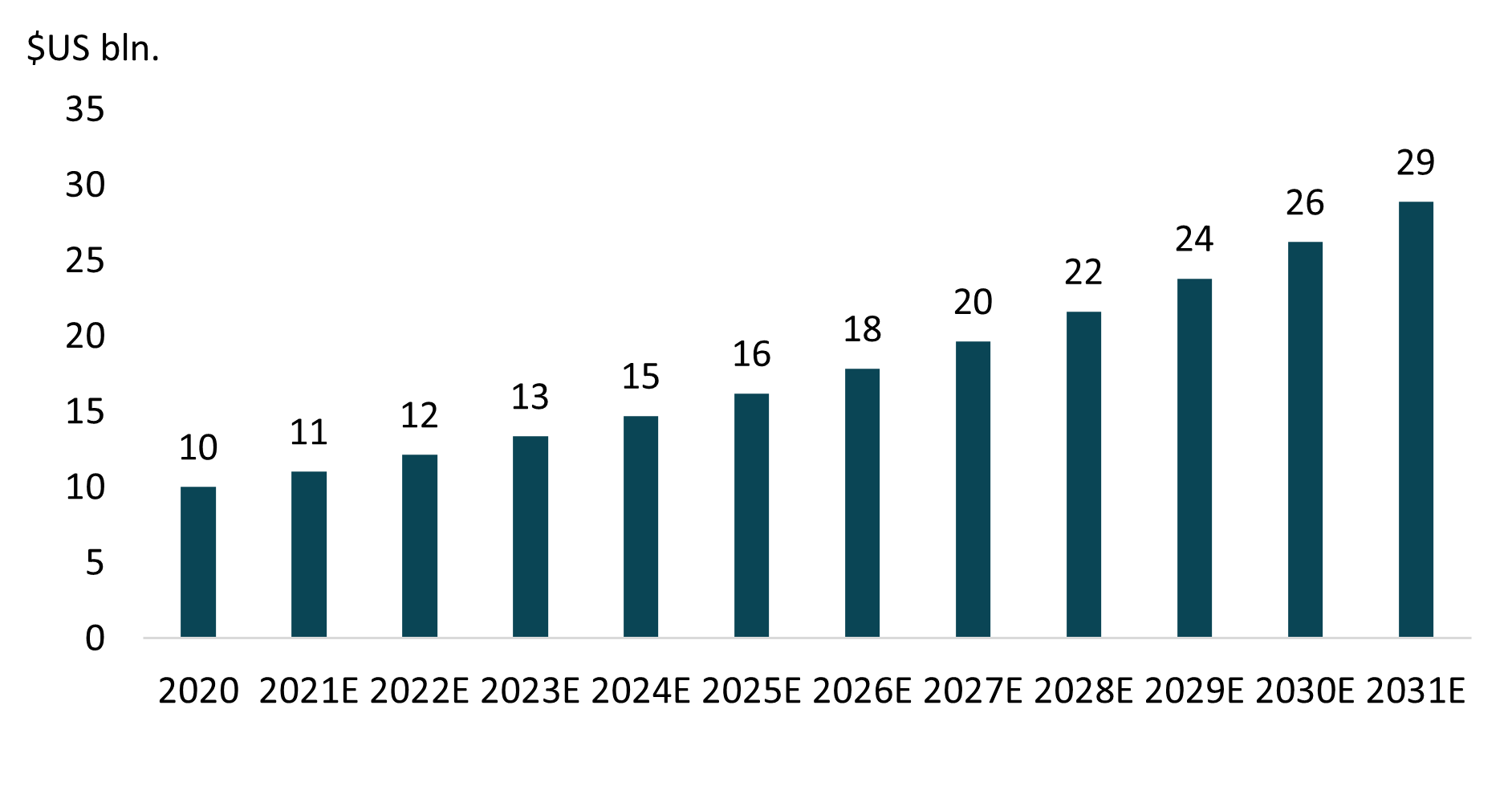

The smart mining market consist of digital and tangible solutions that use advanced technologies to improve productivity, reduce operating expenses, enhance safety, and reduce environmental impact of mines. In 2020, the market was valued at $US 10 billion and is expected to grow at a 10.1% CAGR to $US 28.9 billion by 2031.[9]

Smart Mining Market Development $US billion 2020-2031

Demand Drivers for Smart Mining

The demand for smart mining solutions is driven by macroeconomic trends and challenges faced by the mining industry that have not been or cannot be solved through traditional means.

Decarbonization: Batteries, Electric Vehicles & Clean Energy Technologies

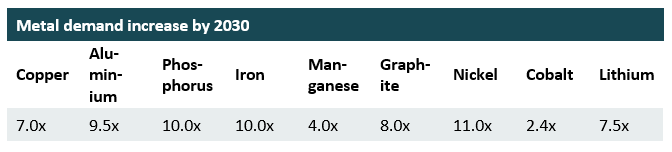

Demand for metals and minerals critical to the decarbonization process, dubbed the transition metals, is expected to increase immensely. The table below based on Australian Government’s Resources Technology and Critical Minerals Processing report[10], shows the extent of expected demand increase for transition metals.

Lack of available high-quality projects

The mining industry is hindered by the lack of available high-quality projects. In practice, all the high grade and easy to extract deposits have been found and are already producing[11].

Lack of high-quality projects is showcased by global exploration results between 2010 and 2019. During this period 852 deposits were discovered[12]. Only 65 (7.6%) of these deposits were rated as high-quality deposits, i.e., tier 1 or tier 2, that provide significant value to miners[13]. The remaining deposits provide limited value. The value of what explorers found only covered 49% of the cost of exploration[14].

The lack of available and the challenge of finding high-quality projects has three implications for the demand of smart mining solutions:

- Companies invest into technologies that improve exploration capabilities and efficiency.

- Companies invest into technologies that improve production efficiency, i.e., the ability to extract more resources from existing deposits.

- Companies invest into technologies that reduce the time it takes for mines under development to begin generating revenues.

Time-to-mine

The time it takes to open a mine is 16 years on average. Exploration, feasibility studies and regulatory approvals take anywhere from 5 to 16 years with mine development taking 1 to 5 years[15][16]. These numbers vary based on specific circumstances such as location, type of ore deposit, regulatory and environmental requirements, and availability of capital.

Smart mining solutions enable time savings in the exploration and feasibility phases as exploration results are analyzed in real-time and orebodies are modelled according to the data.

The prior best practice involved sending samples to laboratories for testing rather than conducting the analysis on site. The removal of logistics, as well as human error, in between sample collection and analysis provides major time savings to explorers and reduces the time it takes explorers to recognize the deposits that contain ore bodies worth extracting.

Moreover, the world’s current metal output capacity is not sufficient to meet future metals demand, which necessitates the opening of new mines. Thus, any technology that reduces the time it takes to open a new mine is likely to see increased demand.

Environmental Concerns

Mining industry has a weak environmental track-record. The industry is mired by disasters that lead to environmental destruction and loss of human life. For example, collapse of the tailings dam at Vale’s Corrego de Feijao mine lead to environmental destruction and the deaths of over 270 people. The more recurring scenario is the inappropriate treatment of acidic tailings, which leads to ground and ground water contamination.

Smart mining solutions alleviate environmental risks by providing solutions that help mines reduce and monitor tailings output as well as separate hazardous from non-hazardous waste rock. Environmental considerations are well highlighted in mining companies’ annual reports as a priority item and will drive spending on smart mining solutions.

Safety Concerns

Mining is a hazardous occupation, with many risks to workers’ health and safety. Smart mining technologies can help mitigate these risks by automating dangerous tasks and providing real-time monitoring and feedback to workers. In some cases, autonomous tools may bring human exposure to mining hazards to zero. Like environmental considerations, safety is a top concern for mining companies.

Conclusion

The trends and drivers for the industry provide a backbone for strong growth as miners and explorers adopt the latest technologies that help them improve mine economics and reduce the environmental and social impact of mining.

Oskari Elojärvi

Analyst

[1] Maus, Victor, Stefan Giljum, Jakob Gutschlhofer, Dieison M. da Silva, Michael Probst, Sidnei L. Gass, Sebastian Luckeneder, Mirko Lieber, and Ian McCallum. “A Global-Scale Data Set of Mining Areas.” Scientific Data 7, no. 1 (2020). https://doi.org/10.1038/s41597-020-00624-w.

[2] R. Anthony Hodge et al., “The Global Mining Industry: Corporate Profile, Complexity, and Change,” Mineral Economics 35, no. 3-4 (2022): pp. 587-606, https://doi.org/10.1007/s13563-022-00343-1.

[3] Grandview Research: Mining Equipment Market Size, Share & Trends Analysis Report 2023-2030

[4] Sources: GlobalData (Mining-technology.com) and annual reports: BHP Billiton | Rio Tinto | Anglo-American | Glencore | Vale | ArcelorMittal | Freeport-McMoran | Teck Resources | Barrick Gold | Teck Resources | Antofagasta | Newmont Mining | First Quantum Minerals | MMC Norilsk Nickel | Vedanta | The Mosaic Company | Severstal | Kinross Gold Corporation | Coal India | Fortescue Metals Group | Grupo Mexico

[5] S&P Global Market Intelligence: Planned mining capital spending to fall $11B in 2023

[6] Base metal prices based on London Metal Exchange prices from FactSet. All prices indexed to the beginning of 2010. 12-Month Moving Average reflects the equally weighted average of copper, zinc, aluminium, nickel, and lead prices indexed to 2010.

[7] Guiomar Calvo et al., “Decreasing Ore Grades in Global Metallic Mining: A Theoretical Issue or a Global Reality?,” Resources 5, no. 4 (November 7, 2016): p. 36, https://doi.org/10.3390/resources5040036.

[8] Earth Resource Investments, “Grade Decline at the World’s Largest Copper Mine,” Earth Resource Investments (https://earth-investment.com/wp-content/themes/earthresourceinvestment/img/logos/supersonic-playground-logo.png 300 80 Earth Resource Investments, September 2, 2022), https://earth-investment.com/en/insight/grade-decline-at-the-worlds-largest-copper-mine/.

[9] Transparency Market Research: Smart Mining Market

[10] Australian Government: Resources Technology and Critical Minerals Processing, National Manufacturing Priority road map. https://www.australiaminerals.gov.au/__data/assets/pdf_file/0006/106449/resources-technology-and-critical-minerals-processing-national-manufacturing-priority-road-map.pdf

[11] Geological Survey of Finland: The Mining and Minerals and the Limits to Growth by Simon P. Michaux. https://tupa.gtk.fi/raportti/arkisto/16_2021.pdf

[12] Schodde, Richard. “Assessing Long Term Exploration and Discovery Performance for Key Minerals in Australia.” MinEx Consulting, November 27, 2020.

[13] “Tiers,” MINEX CONSULTING, accessed March 30, 2023, https://minexconsulting.com/definitions/tiers/.

[14] Schodde, Richard. “Assessing Long Term Exploration and Discovery Performance for Key Minerals in Australia.” MinEx Consulting, November 27, 2020.

[15] “Gold Mining,” World Gold Council, December 14, 2017, https://www.gold.org/gold-supply/gold-mining.

[16] KPMG Global Mining Institute: Ghana Country Mining Guide: https://assets.kpmg.com/content/dam/kpmg/pdf/2014/04/ghana-mining-guide.pdf