Online and e-learning has become mainstream in educational institutes and companies during recent years following the social distancing measures implemented by schools and businesses to combat the Covid-19 pandemic. The increased popularity of the industry is also visible in dealmaking where the transactions have been executed with high valuation multiples.

Covid-19 pandemic boosted the implementation of e-learning solutions

Electronic learning (e-learning) is education via the internet that takes place outside of the classroom. A similar concept, Mobile learning refers to online learning via handheld electronic devices, such as a smartphone or a tablet. E-learning material is designed to be studied using a computer, which leads to the content being more in-depth and time-consuming compared to mobile learning, where the content is often broken down into easily digestible smaller segments[1].

A learning management system (LMS) is a software application that enables users to create, design, and deliver their own course content through a website or a mobile app. LMSs are similar but distinctive from online learning platforms as they tend to be more comprehensive in their functionality and offer support for file sharing, collaboration, data storage, and messaging, whereas online learning platforms are more focused on hosting courses[2].

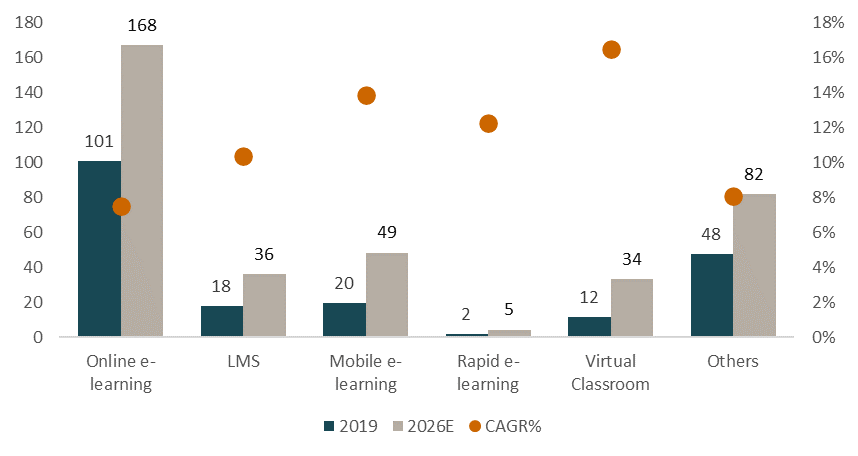

Estimated value of the Global e-learning market in 2019 and 2026, $ billion[3]:

IMARC estimates the size of the global e-learning market, comprised of Online e-learning, Learning Management Systems, Mobile e-learning, Rapid e-learning, Virtual classroom, and other e-learning at $253B in 2021. IMARC expects the market size to reach $522B by 2027, growing 12.8% annually. Statista gives a comparable but slightly more conservative estimate of the market size at $200B in 2019 and $372B in 2026 (CAGR +9.3%)[4].

According to Statista, the largest e-learning segments are online e-learning (51% of total), mobile e-learning (10%), and LMS (9%). Further, Statista estimates that the fastest-growing segments are virtual classroom with a CAGR of 16.5%, and mobile e-learning with a CAGR of 13.9%.

The European e-learning market size in 2019 was estimated at $35.9B with an annual growth of 9.8%[5]. Extrapolating the 2019 market size estimate with the 9.8% growth would give a market size of $47B for the European e-learning market in 2022[6].

The coronavirus pandemic boosted the growth in e-learning as institutions introduced the use of online learning platforms to ensure social distancing, which lead to 1.6 billion students in 190 countries, approximately 94% of all students in the world, seeing their schools at least temporarily closed due to the pandemic by August 2020[7].

The market growth is driven by increasing internet and smartphone penetration, increasing demand for low-cost and convenient learning solutions, and rising adoption of digitalization by educational institutions[8]. Another important driver for the market is the increasing demand for lifelong learning. Data from U.S. shows that 95% of U.S. employers plan to retrain existing employees in response to shifting skill needs. The 2020 Deloitte Global Human Capital Trend report indicates that 73% of employee respondents consider employers responsible for workforce development, implying increasing demand for e-learning solutions from businesses[9].

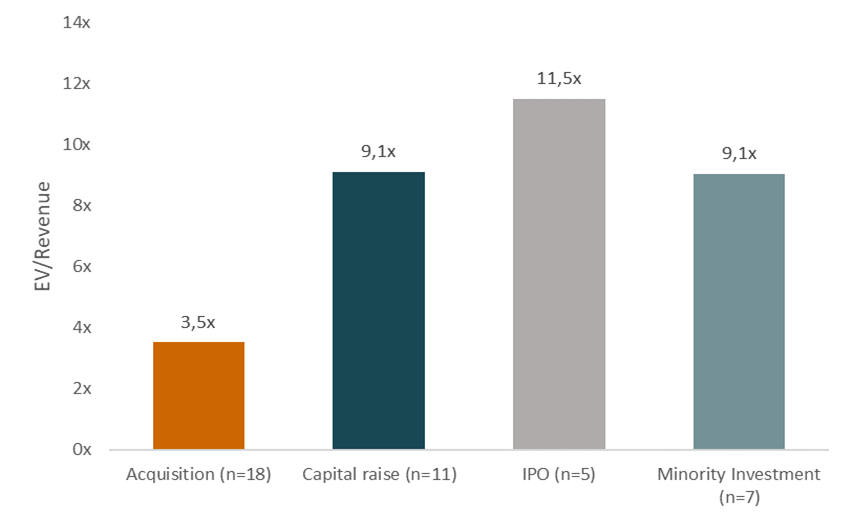

Online learning companies have been trading at high EV to revenue multiples

The online and e-learning industry is relatively young which entails lots of early stage and start-up companies and a significant portion of the deals in the market are minority investments and capital raises where venture capital funds deploy capital into promising companies. A sample of 18 minority investments and capital raises show a median EV/Revenue multiple of 9.1x. The high valuation multiples are typical to venture capital investing where target companies are growing fast, making the historical EV/Sales multiples more a curiosity than a basis for valuation. The valuations are further affected the record high amount of dry powder piled up in venture capital funds that needs to be put to work[10].

The M&A activity in the online learning market has remained at a high level since the Covid-19 pandemic lockdowns provided tailwind for the industry making the companies more attractive targets for investors. Another factor contributing to the M&A activity is that companies have increased their efforts to maintain and upskill their workforce and create better environments for their employees. According to Equity Advisors 42% of learning management system transactions included a buyer outside of the online learning market, which reflects the trend of companies seeing the value of in-house online learning systems to create better working environments[11].

A sample of 18 acquisitions with known multiples, that represents a small portion of the overall M&A deals in the market, gives a median EV/Revenue multiple of 3.5x. The multiple, while high, is significantly lower than the multiples on capital raises and minority investments, most likely due to the more mature phase of the M&A targets compared to the companies that resorted to capital raises or minority investments.

Median EV/Revenue multiples, sample of transactions with known multiples 2018-2022[12]:

Includes transactions where the target was from North America or Western/Northern Europe.

Minority investments refer to investment in existing shares and capital raise to investment in new issue of shares.

Matti Kari

Associate

[1] Signable: Mobile learning is the future.

[2] eLearning Industry: LMS Vs. eLearning Platform: The Key Differences

[3] Statista: Size of the global e-learning market in 2019 and 2026, by segment

[4] IMARC: E-Learning Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2022-2027 (Retrieved 17.11.2022); Statista: Size of the global e-learning market in 2019 and 2026, by segment

[5] Bonafide Research: Europe E-learning market 2020-2026 by Offering, Learning Mode, Technology, Material Source, Application, End User, and Country

[6] Graphical Research: Europe E-Learning Market Size By Application; Research and Markets: E-learning Market; The Business Research Company: Mobile Learning Global Market Report 2022; Straits Research: E-learning market.

[7] Coursera Inc.: IPO Prospectus 2021

[8] Graphical Research: Europe E-Learning Market Size By Application; Research and Markets: E-learning Market; The Business Research Company: Mobile Learning Global Market Report 2022; Straits Research: E-learning market. (Retrieved 17.11.2022)

[9] Coursera Inc.: IPO Prospectus 2021

[10] Pitchbook: Why is VC dry powder still piling up?

[11] Tequity Advisors: M&A Trends in Learning & Development Tech

[12] Factset; Zephyr