The global composites market is thriving. The advantages of the composite materials – high strength-to-weight ratio and long product lifespan and flexibility – are driving demand for composite technologies in industrial, transportation and aerospace applications. Especially, Carbon Fiber Reinforced Plastics (CFRP) have been gaining a foothold among the industries that have previously relied heavily on other traditional materials such as metal and aluminium. The triumph of CFRPs is expected to continue, supported by global trends of sustainability and energy-efficiency.

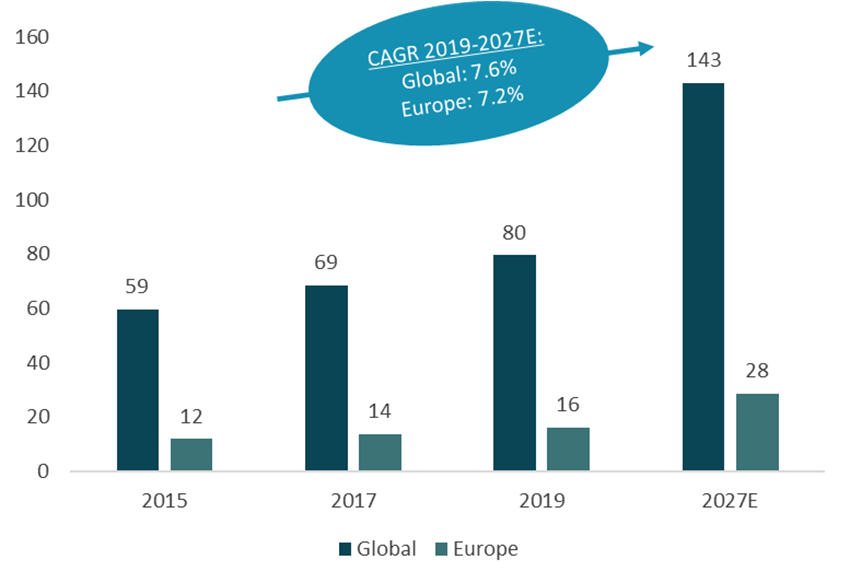

According to Grand View Research’s (2020) report, the global composite materials is an €80B market, set to grow at a 7.6% (CAGR) in 2019-2027. CFRP’s account for around a fourth of the market, giving a market size of €20B. Assuming that the market follows the high growth figures of global carbon fiber demand, the CFRPs are estimated to grow annually roughly 7-10% until 2025.

Composites, fiber reinforced plastics (FRP) in general

Composites are combinations of two or more insoluble materials. They are divided into three main categories based on the matrix material from which the composite is made of: polymer matrix (PMC), ceramic matrix (CMC) and metal matrix composites (MMC). The main purpose of manufacturing composites is to optimize the positive properties of selected materials, such as strength and durability, while minimizing the negative ones.

Generally, composites are manufactured by utilizing a matrix material that joins and bonds all other materials, such as reinforcing fabrics, together. The matrix protects the fibers, makes the combination durable and resilient to corrosion and transmits the load or strain of weight to more enduring fiber structures. The typical matrices include thermosetting plastic (resin), thermoplastic, gelcoat and topcoat.

The reinforcement fibers are utilized in composite combinations to enhance the properties of the plastics. The main purpose of the fibers is to carry the overall load or strain that is transmitted to the composite structure. The strength properties and flexibility of the composite combination can be altered in multiple ways. For example, the reinforcement fabrics can be weaved with different styles or from varying types of strings, the combination of fabrics can be chosen or more fabric layers can be added, all of which change the outcome. The most utilized reinforcement fibers include glass fibers, carbon fibers and Kevlar (para-aramid).

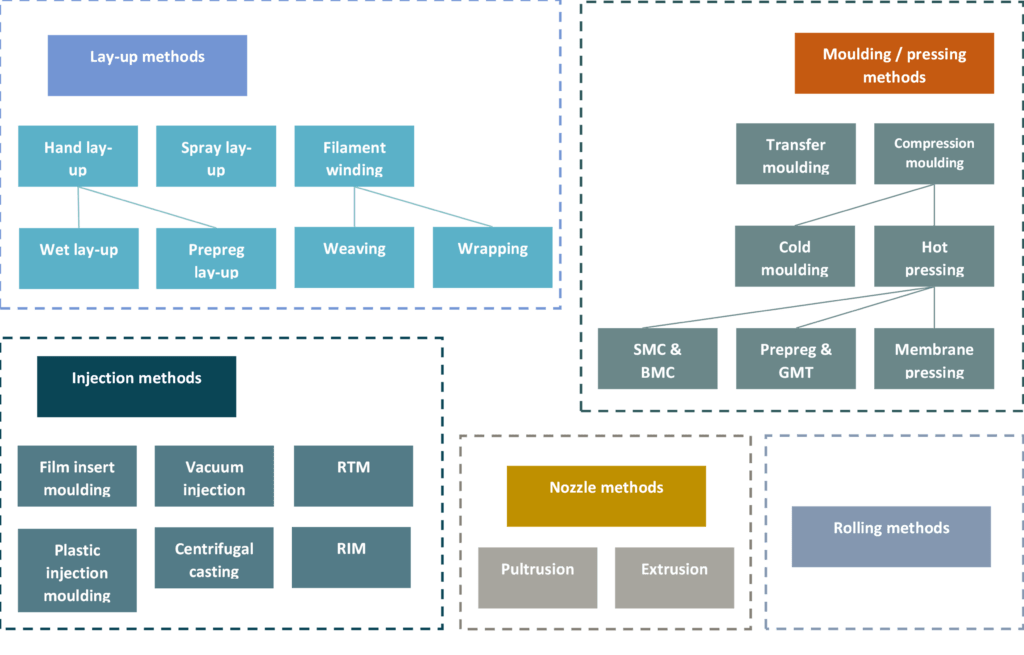

Depending on the final product, composites are manufactured with numerous different methods and techniques[1]. The most common processes include:

- Traditional lay-up. A manual method for manufacturing smaller series of products by placing the fibers and wetting them down manually with resin.

- Filament winding. A method for producing composite piping and tanks by wetting the fibers down with resin and then pulling them over a rolling mould.

- Vacuum injection and RTM. Methods for producing complex composite products and structures by injecting resin into a vacuum where fibers are placed.

- Pultrusion. An extrusion method for producing composite pipes and profiles by wetting the fibers with resin and then pulling the fibers through certain shapes.

- Lamination. A method for manufacturing sandwich structures and lightweight structures by putting together for example light core materials and stiff fibers, impregnated with resin.

Different composite manufacturing methods[2]

Global composites market

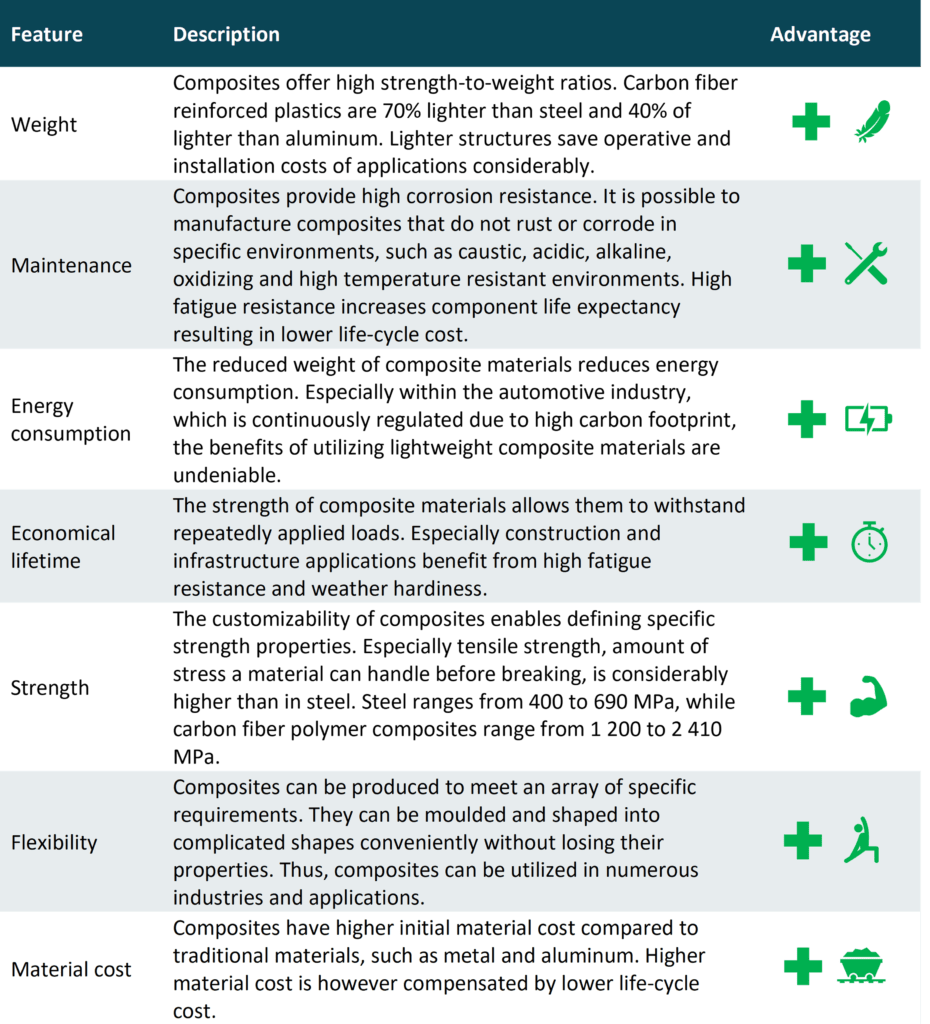

The global market for composite materials is estimated at roughly €80B in 2019. The market is expected to increase to €143B by 2027, growing at a 7.6% compounded annual growth rate (CAGR). The market is driven primarily by the benefits of composite materials: reduced weight, low maintenance, energy efficiency and long economical lifetime i.e. lower life-cycle cost, all supporting the global trends of sustainability and energy-efficiency. As a result, the demand for durable composite solutions have increased significantly over the last decades. Especially, the automotive and transportation industries, in a search of cost-savings and competitive edge, have benefited from introduction of lightweight and durable composite plastics.[3]

Advantages of composite materials[4]

The European composites market accounts for roughly 20% of the global market. This sets the euro-denominated market size at around €16B. The European market follows the development of the global market, driven by the same global trends focused on overcoming the environmental challenges related to global material production. The fastest-growing product segment of composites in Europe is carbon fiber reinforced plastics (CFRP), that is increasingly utilized in industrial, transportation and automotive applications.[5]

Market value of composites globally and in Europe (€B)

Carbon fiber reinforce plastics submarket

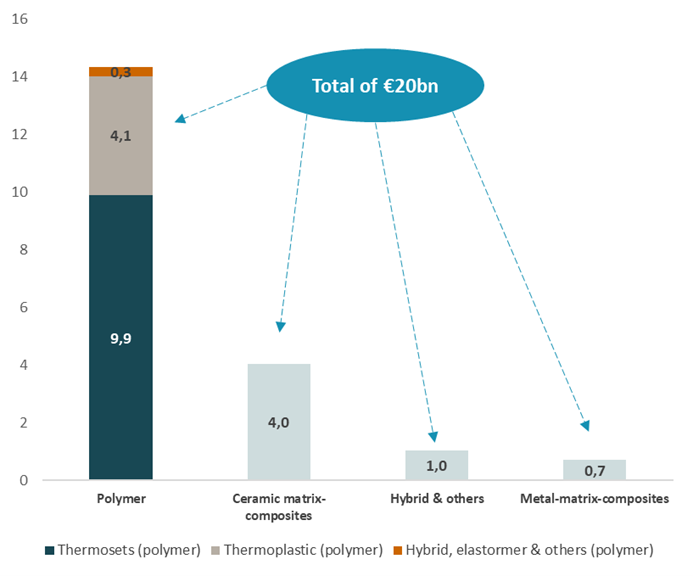

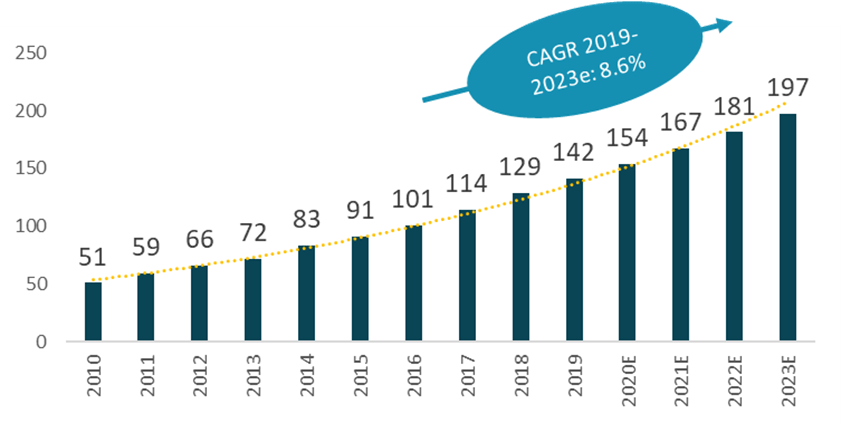

Carbon fiber reinforced plastics (CFRP) account for around one fourth, €20B of the global composite market, polymer (resin) being the most utilized matrix material. The market is expected to grow significantly over the next years, as increasing demand for carbon fiber based composite solutions leads carbon fiber to win market share from other materials such as metal and aluminium. The growth of the market share is both a result of increasing popularity among existing carbon fiber solutions as well as expansion of carbon fiber to new product application areas. Measured in metric tons, demand for carbon fiber is estimated to reach compound annual growth rate of 8.6% (CAGR) in 2019-2023. As such, the euro-dominated market is expected to grow almost 40% in only four years, promising high growth for the carbon fiber composite producers.

Global carbon composites revenue in 2018, by matrix material (€B)

The demand for carbon fiber has been rapidly increasing over the last decade. The market has been driven primarily by changes in the carbon fiber application areas, as the carbon fiber reinforced plastics have found their way to new industries. Especially the aerospace and defence applications have grown significantly, becoming the largest consumer area of carbon fiber solutions. Further growth is driven by the industries’ huge order backlogs while the automotive and transportation industries have significantly increased their consumption of carbon fiber during the past years in order to comply with the ever-tightening CO2 emission regulations. As global concern towards the reduction of carbon footprint increases, so does demand for lightweight and durable solutions replacing less efficient and more consumptive traditional solutions.[6]

Global carbon fiber reinforced plastics demand (in 1 000 metric tons)[7]

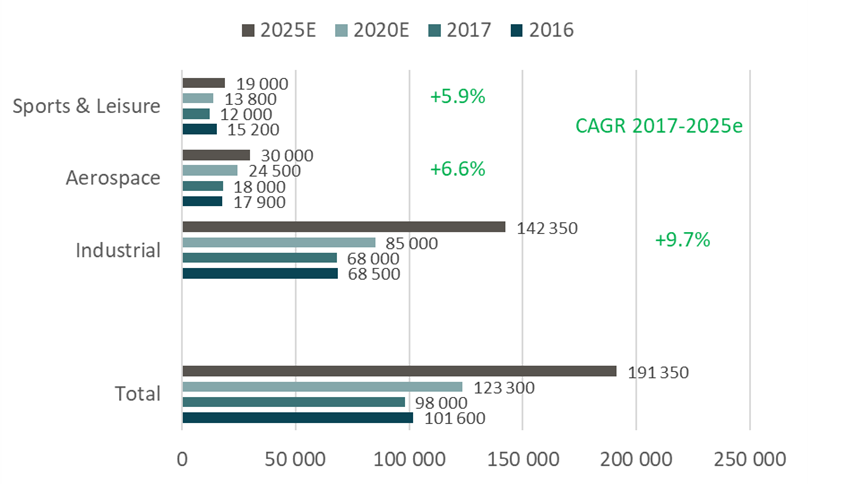

The carbon fiber market is expanding. In addition to aerospace and automotive industries, carbon fiber-based solutions are to an increasing degree being used in other application areas. E.g., industrial subsegments such as mechanical engineering are currently experiencing high demand of carbon fiber materials, and the market is growing fast.[8] The industrial segment’s demand for carbon fiber is expected to surpass the other segments in the upcoming years. The respective compounded average growth rates (2017-2025E) for the segments are: industrial +9.7%, aerospace +6.6% and sports +5.9%.[9]

Global carbon fiber demand by market (in metric tons)

Assuming the overall CRFP market follows the regional division of the composites market, we estimate the European CRFP market size at ~€4B. The market is estimated to follow the high growth figures of global carbon fiber demand at 7-10%.

Aleksi Pulkkinen

Analyst

[1] Finnish Plastics Industries Federation (Muoviteollisuus Ry).

[2] Composites and their most important applications. September 2015. Emma Vikstedt. Bachelor’s Thesis, TAMK.

[3] Global Composites Market Size, Industry Report, 2020-2027. Grand View Research.

[4] American Composites Manufacturers Association (ACMA): Composites Lab.

[5] Europe Composite Market Analysis Report, 2019-2025. Grand View Research.

[6] Composites Market Report, 2018. Carbon Composites e.V.

[7] Composites Market Report, 2019. Carbon Composites e.V.

[8] Composite Material Market – Growth, Trends, Covid-19 impact, and Forecasts, 2021-2026. Mordor Intelligence.

[9] Composites World Magazine, March 2020. Composites World.